Some of the most interesting and profitable members that have been admitted to The Financial Log Book have been fledgling companies built around innovative ideas: Silver Wheaton for its new-at-the-time streaming model for mining; Abitibi Royalties Inc. for its novel approach to grub staking mining claims; and, Clean Seed Capital for its farmer-led innovation for a next generation seeder.

The first two investments were very successful and there is the possibility of a major upside for Abitibi. Moreover, the potential increase in revenues for Abitibi will be achieved without Abitibi having to shoulder the costs for development work at Canadian Malartic.

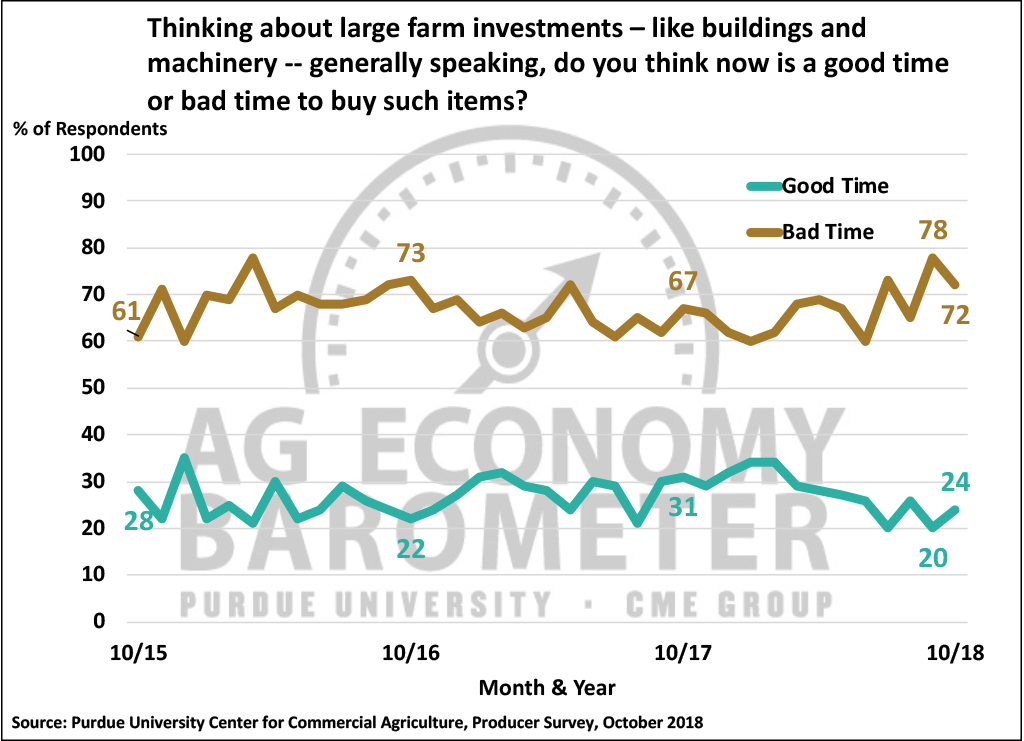

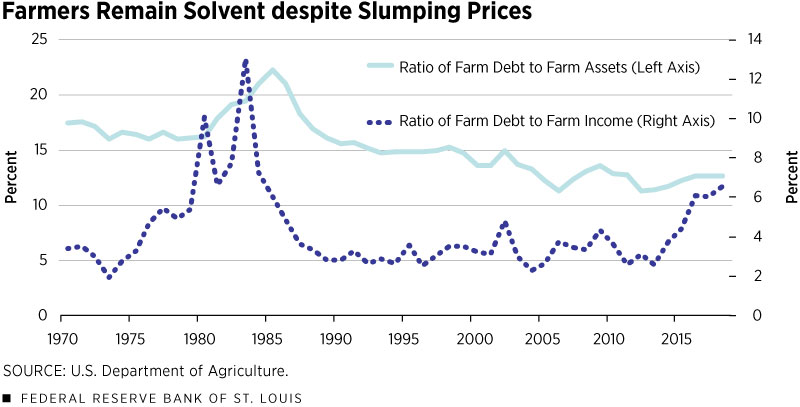

The full potential of Clean Seed has yet to be realized, but the signals are there. See the company's most recent news releases and financial reports. Unfortunately, the depressed state of the farming sector has hindered sales of the CX-6 Smart Seeder but that will pass. Since establishing an initial position in April 2015, I added to our holdings as the company has passed various milestones. I plan to increase my stake in 2019. The share price has declined notably in 2018 in concert with other agriculture-related listings. However, I regard it as a buying opportunity. The original investment was made with a 5 - 10 year time horizon and the view that the path of bringing the technology to market would be arduous. So far, I have seen no reason to change this outlook.

The Risks of Investing in New Enterprises

The risks are significant:

- technological risk - nothing ever works the first time: tinkering is always required ... and it takes time

- financial risk - it's always difficult to get financing with reasonable terms and to find patient investors who are prepared to weather the up's and down's of new enterprises

- market risk - competitors may develop better products or established suppliers may lower prices to the point where the product has no competitive advantage

- awareness - building a robust customer base is always a difficult challenge

- intellectual theft - always a possibility, especially from individuals in countries such as China where the rule of law does not prevail

- management risk- key personnel may leave or founders may not have the wisdom to involve others with the skills to take an idea to the next level

- operational risk - things will always go wrong in the delivery of products and services, especially during the early going before the kinks are worked out

Coping with Risk

It's all about people. A significant part of my time is spent assessing the people associated with an enterprise: their character (integrity, perseverance, commitment); experience in launching new businesses; academic and other professional qualifications; ability to work with others and get things done. I especially like people with "muddy boots" - individuals who have a direct working experience in the worlds of their target markets. In this respect, the value of professional and social networks cannot be underestimated. I have an aversion to the involvement of inexperienced MBA's and other financial types in start-ups, especially those who migrate from business schools directly to the financial world and consultancy: people with clean fingernails. One exception: the very few MBA's who have spent time "down on the farm".

I always allow time for a company to "find its sea legs" before investing in it. I look for the achievement of milestones such as:

I always allow time for a company to "find its sea legs" before investing in it. I look for the achievement of milestones such as:

- a working prototype tested under the conditions it will be used in the real world

- a realistic assessment of the cost/benefit to potential clients

- the costs of producing and delivering the product/service to customers

- a realistic assessment of the market. A story in this regard. It is common for companies to cite figures such as a "trillion dollar market" or "the industry of the future". I NEVER heed this bullshit. Why? In a previous incarnation, I was involved in an effort to expand the Ontario Provincial Parks by 204,000 km2 (1.9 percent of the province). As part of the workup to the approval by Cabinet, we made a presentation to some Treasury Board staff and included some optimistic takes on the economic multiplier effect these parks would have on the economy. Staff rolled their eyes and then took us to the intellectual woodshed. "Using the same logic, the engineers at the Ministry of Transportation would have it that by paving over all of Ontario, the province would be the richest place on earth." We meekly tucked out tails between our legs and never suggested it again. And yes, we were successful in bringing 155 new parks into the system.

I always spend time in looking at a company's intellectual property. If patents are involved (and they are not always needed) I look to see what they involve, where they apply and when they expire - also any potential complications such as infringement.

I look at a company's financial situation: its ability to secure additional financing (and at what terms), income, burn rate, potential for profitability in the short term. Its share structure is also important.

I look at the agility of management - the ability of a company to adapt quickly to changing circumstances. This includes things such as a change in strategic and operational focus, recruiting people with the skill sets to bring the business to the next level, responding to customer feedback and regulatory demands.

NOTE:

Very few of these assessments involve an exhaustive review of financial spreadsheets. Spreadsheets can be manipulated. I ignore forward-looking statements of income as these are notoriously inaccurate - better to ask a high priestess to look at animal guts spread out on an altar or listen to The Business Network.

CO2 GRO Inc - A New Crew Member

CO2 GRO Inc - A New Crew Member

Introduction: My Approach to Investing in Cannabis

It is often said that the only people who get rich during gold rushes are those who provide the shovels. With this in mind, I started to investigate companies which supply products and services to the growers of cannabis as opposed to making bets on cannabis growers. My investigation (still continuing) explored several avenues: automated growing systems, providers of essentials such as light, nutrients and nutrient delivery systems, inventory control systems, etc. After a few months a few things became apparent:

- The "ecosystem" is fragmented with many players ranging from mom and pop operators to multinationals (who would offer little in the way of returns as meeting the needs of the cannabis industry would represent a tiny part of their revenues e.g. LED light manufacturers).

- Barriers to entry for most technologies are fairly low and the number of competitors is high.

- Most enterprising growers can cobble together their systems on a custom basis without incurring unacceptably high costs in terms of potential returns.

- It is difficult to find listed "pure play" companies within this niche.

Company Snapshot

The company is based around a patented technology whereby CO2 can be infused into water. When sprayed on foliage, the CO2 enhanced water results in faster growth and higher yields.

As of late 2017, CO2 GRO’s sole focus is commercializing its patent-protected CO2 gas infusion technology license and its patent-pending US PTO CO2 foliar spray, both of which form the Company’s Dissolved CO2 plant-production platform. Prior to the 4th quarter of 2017, the Company was a producer and marketer of

natural specialty shrimp and algal oil products that formed CO2 GRO’s 3 other business platforms pursuant to a license agreement signed in October 2014

https://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=00032690&issuerType=03&projectNo=02843331&docId=4419823

The previous business was essentially moribund. However, some bright people realized that the technology was well suited to accelerating the growth of high value plants such as cannabis, lettuce, peppers etc. This was no surprise given the close connections that management and the board have with the University of Guelph, a vibrant centre for agricultural research and the commercialization of research discoveries. And so, in a remarkably short period of time, the company changed focus and commenced efforts to exploit a potentially profitable opportunity.

Why I Decided to Invest

1. Leadership

Management is experienced in the way of bringing new products to the marketplace: financing, operations, trials etc. It has a very extensive network of contacts. I know one of the members of the board through my work in a previous incarnation (some 15 years ago and beyond) and can attest to his energy, ethics, and ability to work productively with others. (I haven't been in contact with him for almost 20 years.) I believe firmly that you are known by the company you keep and visa versa. I was also impressed by the financial commitment shown by management. Having skin in the game is meaningful.

2. Business Acumen

The strategic shift of direction is very significant in that it demonstrates the ability of management to adjust to new opportunities. However, there are other aspects of the company's business approach that attracted me as well:

- the business model does not burden customers unduly with upfront costs and reduces risk, especially for early adopters

- the model also ensures a continual flow of income as opposed to a series of one-off events

- I appreciate management's approach to managing its financial resources (spans everything from minimizing the cost of trials to remuneration for field representatives)

- I like management's focus to limit its initial efforts to North America - this as opposed to trying to do everything at once and all that entails

A few aspects impressed me:

- the technology actually delivers on its promise as demonstrated by real world tests in a variety of situations (see extract below)

- the simplicity of the application of the technology and the ability for treated water to be delivered via a variety of irrigation systems at what I assume at a fairly low cost and without a lot of rejigging of existing systems

- a technology which can be applied in a variety of situations ranging from greenhouses to open fields, from cannabis to flowers and high value leaf crops

- the technology is scalable

- the company does not have to maintain an large inventory and my bet is that off-the-shelf products are cheap and readily available in order to install misting systems

4. Strategic Positioning

The company is in a sweet spot. The business risk to potential customers is very low. There is the prospect of increasing profits using a technology that does not clash with existing set-ups and operating methods.

As this time especially, I am looking for companies which have the potential to prosper in the event that the general economy slides into recession. The legalization of cannabis for recreational use will, over time, result in a change in the general level of social acceptance of cannabis. I believe that cannabis holds a cost advantage over alcohol for individuals who wish to "relax". Further, there is a growing use of cannabis products for medical uses to treat conditions which are concentrated in baby boomers, a cohort which is significant. Further, with climate change, entrepreneurs are searching for technologies to enhance plant growth under controlled growing environments which as less susceptible to seasonal fluctuations in weather during the growing season.

Some people spend an inordinate amount of time scouring financials and rooting around in what I call "financial trivia". This is understandable as this behaviour is expected by the clients of financial analysts and investors who do it simply because "it's the thing to do". However, the level of detail in analysts' reports is mostly not necessary. I will be writing about this in a later post. In brief, my contention is that the application of a few "rules of thumb" (heuristics) is far more beneficial to one's portfolio than an exhaustive analysis which typically focuses on the wrong things and things that simply cannot be known such as forward earnings. I will continue with this rant in a few weeks' time.

As a result, I narrowed my focus to a few key things.

After reviewing the company's filings, I came across this pithy statement.

INTERIM MANAGEMENT’S DISCUSSION AND ANALYSIS QUARTERLY HIGHLIGHTS Three months ended September 30, 2018

Corporate Operational update During the third quarter of 2018, the following activities took place:

Three cannabis dissolved CO2 foliar spray grow trials were press released. Buds from the dissolved CO2 plants and buds from the no CO2 gassing control group plants were analyzed by SGS Canada Labs, an accredited Health Canada Company. Speed to plant maturity of 28%-33% and bud yield increases of 20- 22% were very consistent for the three different strains grown. However, the THC content in the indica buds shot up 75% over the control group bud THC levels versus 20-22% greater for the sativa and hybrid strains.

The Company received a favorable response from the Canadian Food Inspection Agency (“CFIA”) that the Company's CO2 gas and water mixing technology “does not create a supplement” and “does not fall under the Purview of the Canada Fertilizer Act and Regulations”. This allows all Canadian food and non-food plant food growers to use dissolve CO2 Foliar Spray other than Licensed Producers (“LPs”) of Canadian Cannabis. LPs are bound under Bill C45 to not use any foliar spray with supplements or additives. The Company has filed an exemption request from CMC Compliance Issues and Response Section of the Cannabis Legalization and Regulation Branch for its dissolving CO2 foliar spray technology. The Company believes that its dissolved CO2 rich natural water is still natural water as also concluded by the CFIA.

NaturalwaterisallowedbythisHealthCanadaCMCBranchforLPstofoliarsprayontheircannabis cuttings at minimum.

As of September 30, 2018, there were two pepper grow trials underway in Michigan and various micro green grow, manually at a commercial aeroponics grower and at St Cloud State U (SCSU), which is fully automated and various micro green grow trials with one limited tomato grow trial. The Company replicated its 2013 University of Guelph's best successful lettuce-grow trial results of 100% over CO2 gassing in Q3, 2018. Two Q3, 2018 scientific studies at St Cloud State using CO2 foliar spray were press released that concluded 400% additional chlorophyll and 800% additional CO2 conductance (transfer) can be created using dissolved CO2 foliar spray coating leaf surface area over CO2 gassing. Also press released was that the top of a romaine leaf surface area is essentially as effective absorbing dissolved CO2 as the bottom of a romaine leaf where most leaf stoma (pores) reside that intake CO2 gas.

As of September 30, 2018, the Company had 20 CO2-grow trial reps reporting to the Company’s VP of Operations. All sales reps remain on zero retainers with 100% commissions paid only upon commercial installations of dissolving CO2 equipment. A project engineer (half time) and a full-time bio-scientist will be joined by Dr. Matt Julius who will be acting Chief Science Officer effective January 1, 2019 as was announced. The Company’s confirmed, likely and conditional client list grew to 70 companies expressing interest to trial dissolved CO2 foliar spray, indoors or outdoors.

... also ... view this:

video link

https://www.youtube.com/watch?v=27bqMiofLUU&feature=youtu.be

I established an initial position in mid-December 2018 and tripled it shortly thereafter upon further reflection.

What I Will Be Monitoring

- Most important thing: I will look to see if the company receives regulatory approval for the application of its technology to cannabis plants in Canada. This will be a major catalyst.

- I will look for the further results of trials to see how the technology works in a variety of situations. In this regard, I would like harder information about the value proposition for growers (this information would probably be subject to a non-disclosure agreement if even management would agree to it)

- I would like to learn more about how the company intends to establish a baseline for its clients' production before and after the application of its technology as a basis for determining its share of income streams.

- I worry about the company's ability to recruit people and the technological capacity of field representatives in installing, maintaining and monitoring installations. Having a PhD is no guarantee of competence. In many instances I have found that an undergraduate degree is better as the people are generally more flexible and amenable to new situations. I hope that the company has internal processes to ensure that the standard of delivery is uniformly high and that they have robust feedback mechanisms with their customers.

After that, another person was chosen to leave the room for another round. The idea was to observe the process to detect subtle clues that were inherent in the way the presenter pointed to the squares. Through close observation, it was possible to detect a pattern. Those who were able to identify the chosen square were asked to not reveal their finding to the rest of the group.

The first people to "get" the right answer were the secretaries, one of them on the second round. After a few iterations, most people got the right answer by the 4X4 grid.. It involved being alert to subtle clues which became more obvious at the game progressed. We were beside ourselves when the number of choices was reduced to 2. And who were the last people to finally "get" the answer? Two PhD's! And believe it or not, their job was to find mines! My dear long-departed dog could have done better. This said, some of my best friends are .... and lawyers.

Concluding Remarks

While it is always risky investing in emerging companies before they achieve significant revenue streams, I have the sense that this company has the potential to become very profitable. My major concern is with regulatory risk. There is considerable uncertainty in the regulatory area, especially as government is proceeding very carefully for political reasons and the newness of the cannabis industry. Investors must understand that civil servants in all levels of government these days are becoming exceedingly risk averse and loathe to take direct "ownership". Deflection and prevarication are the order of the day. This is reflected in appallingly slow decision making and the ambiguity of compromise when clear direction is required. Sadly this condition prevails regardless of the political party at the helm. It's a product of "top down" government and a 24/7 news cycle where political operatives in short pants at the ministerial and cabinet levels lack knowledge and experience and are prone to fear biting and self-protection as a result. The consequences to emerging companies can be significant.

In light of this, I sized my position in the company to represent less than 4 percent of one portfolio. It's a balance of regulatory risk on one hand and my faith in the company. Also - there is no sense in minimizing an initial position as it negates the possibility of meaningful gains. With investments of this nature, I am prepared to accept volatility and to be patient ... always with the thought that I'm willing to experience the loss of most, if not all, of my initial stake. I reason that if I can bat .300 with beasts of this nature, my portfolios will do exceedingly well over the long term. This said, I don't make bets of this nature very often.

Concluding Remarks

While it is always risky investing in emerging companies before they achieve significant revenue streams, I have the sense that this company has the potential to become very profitable. My major concern is with regulatory risk. There is considerable uncertainty in the regulatory area, especially as government is proceeding very carefully for political reasons and the newness of the cannabis industry. Investors must understand that civil servants in all levels of government these days are becoming exceedingly risk averse and loathe to take direct "ownership". Deflection and prevarication are the order of the day. This is reflected in appallingly slow decision making and the ambiguity of compromise when clear direction is required. Sadly this condition prevails regardless of the political party at the helm. It's a product of "top down" government and a 24/7 news cycle where political operatives in short pants at the ministerial and cabinet levels lack knowledge and experience and are prone to fear biting and self-protection as a result. The consequences to emerging companies can be significant.

In light of this, I sized my position in the company to represent less than 4 percent of one portfolio. It's a balance of regulatory risk on one hand and my faith in the company. Also - there is no sense in minimizing an initial position as it negates the possibility of meaningful gains. With investments of this nature, I am prepared to accept volatility and to be patient ... always with the thought that I'm willing to experience the loss of most, if not all, of my initial stake. I reason that if I can bat .300 with beasts of this nature, my portfolios will do exceedingly well over the long term. This said, I don't make bets of this nature very often.