This is fine ... but:

- Some individuals such as retirees don't often have the luxury of waiting for market cycles to correct, especially if they retire when the market heads south.

- Holding on through thick and thin is contrary to the human experience. By nature, we are adapted to living in cycles: from our daily routines, to the yearly cycle of farming, to the longer-term responsibilities of raising children ... and so on.

- Investors are a fickle lot. They are driven by fear and greed and are not rational economic automatons.

In order to refine my approach I've done a lot of research on cycles. Of the lot, Howard Marks' writing is THE BEST: based on a wealth of practical experience, a sound academic background, years of thinking and interaction with many successful investment professionals. Moreover, he writes well.

Howard Marks - Letters

Howard Marks has been in the investment business for more than 40 years. He is the Co-Chair Oaktree Capital Investments, an organization which manages about $124 billion in assets for pension funds, sovereign wealth funds and corporations.

His Letters from the Chair have been issued since 1990. The memos provide deep insights into the world of investing and are well worth reading. You can subscribe by going to this link (which also provides access to other material):

Memos from Howard Marks

His most recent book, Mastering the Market Cycle - Getting the Odds on Your Side (2018) contains a synthesis of observations. He draws on more than two decades of his memos.

One of the striking things about the book is the consistency of his thinking. He is not shy about noting the sometimes repetitive refrains which reverberate in his memos over time. To my mind, this is a real plus.

In their search for variety many writers on things financial venture forth into areas where they are inexperienced or lack the depth to get beneath surficial matters. This is the lot of most financial writers in the media. They respond to editors' blandishments for variety and articles to encourage advertisers to continue with their support to publications. For this reason, I ignore the financial press for the most part.

In contrast, Marks is the real deal. He is rich. Why? Because he and his crew were successful in meeting the expectations of clients. Good enough for me ... and I figure that I can gain insights from his experience.

The Three Foundations of Sound Investment Management

In the introductory remarks, Marks notes that sound investments are based on two major elements (in addition to heeding market cycles):

- a superior knowledge of "knowables" e.g. the fundamentals of industries, companies and securities

- paying an appropriate price on the basis of the fundamentals.

For the most part, the rest of his book is based on the third foundation - "understanding the investment environment we're in and deciding how to strategically position our portfolios for it.

A Few Highlights for Me

I've read Mastering a few times. Here are a few of my major take-aways:

About Cycles

One of the key words required if one is to understand the reasons for studying cycles is "tendencies."

If the factors that influence investing were regular and predictable - for example, if macro forecasting worked - we would be able to talk about what "will Happen." Yet the fact that that's not the case doesn't mean we're helpless in contemplating the future. Rather, we can talk about the things that might happen or should happen, and how likely they are to happen. That is what I call "tendencies." [p.12]

The Superior Investor's Perspective

The superior investor is attentive to market cycles. ... he gains a sense of where we stand in the various cycles that matter [my emphasis], and knows those things have implications for his actions. This allow him to make helpful judgments about cycles ... specifically:

- Are we close to the beginning of an upswing, or the later stages?

- If a particular cycle has been rising for a while, has it gone so far that we're now in dangerous territory?

- Does investors' behaviourd suggest they're being driven by greed or by fear?

- Do they seem appropriately risk-averse or foolishly risk-tolerant?

- Is the market overheated (and overpriced), or is it frigid (and thus cheap) because of what's been going on cyclically?

- Taken together, doe sour current position in the cycle imply that we should emphasize defensiveness or aggressiveness?

All It Takes

All it takes for the perpetual market machine to grind to a halt is the failure of one or two assumptions and the operation of some general rules:

- Interest rates can go up as well as down.

- Platitudes can fail to hold.

- Improper incentives can lead to destructive behaviour.

- Attempts to quantify risk in advance - particularly as to novel financial products for which there is no history - will often be unavailing.

- The "worst case" can indeed be exceeded on the downside.

The Agricultural Sector - A Low Part of the Cycle

Things are bleak.

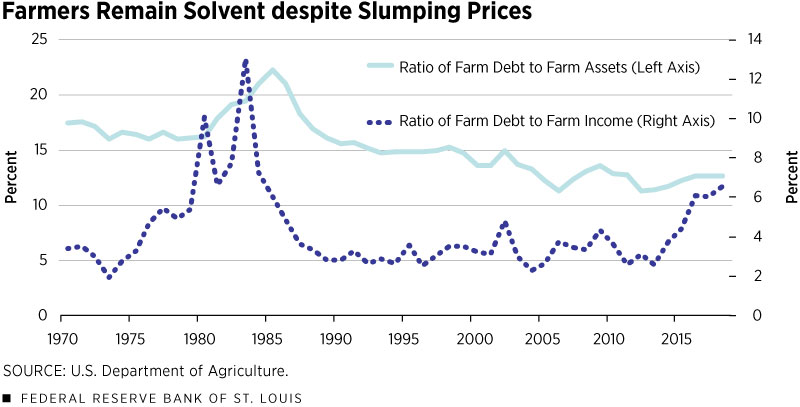

Dropping commodity prices have caused net farm income to plunge about 40 percent since its 2013 high and credit conditions to tighten.

U.S. farmers also face headwinds of record harvests and trade disputes.

Despite tough market conditions, the farm sector has remained relatively well insulated from potential solvency impacts.

A Tale of Two Economies

There is a positive dimension to this for patient investors. Drawn from the above-noted article, the graph shows that farmers have learned through hard experience to manage debt. There is the prospect that, when commodity prices increase (and they will), farmers will be positioned to spend significant amounts on equipment, provided interest rates remain "reasonable". In recent years, most farmers have economized on equipment expenditures but there is a point where the supply of reliable used equipment may not be sufficient to meet demand, hence the need to purchase new. I continue to monitor this situation closely. Fortunately, there is a wealth of data to use in this regard.

No comments:

Post a Comment