I have learned to ignore the financial press and reports produced by most financial analysts. Why?

- Many of the writers pen their articles out of sheer self interest: to promote their "brand" in a search for a larger client base for their services; to promote the interests of their clients (e.g. listed companies who generate advertising revenue); to bask in the glow of public notoriety.

- The articles are seldom balanced - most always slanted in favour of one-sided perspectives ... and which almost always, fail to acknowledge uncertainty.

- Most financial analysts are unoriginal and think along the conventional lines of thought drilled into them in business school. Further, most of them simply do not have the time to think deeply. For this reason, I generally ignore their reports save to dip into the vault on occasion to see the mode of thinking which prevails at the moment ... and yes, there are distinct shifts in style over time.

- Most articles in the press are shallow, short, and deal with the "minutiae of the moment" - mostly inconsequential events - instead of meaningful long-term trends. This is understandable as writers are always searching for new material to populate their articles. And unless they produce something "different" they are likely to have issues with their editors. In contrast, some thoughtful writers such as Howard Marks would never survive with a daily column as they are very repetitive and sing much the same song line over time.

- With the exception of self-promoting fund managers, the authors are not rich. (And even then, most of the so-called financial geniuses, who administer funds have sub-par performance over the long term when compared to market indices.) Why, then, sign them on as your financial navigator?

- Most important, the articles seldom contain profitable ideas. Either they are "yesterday's news" where major profits have already been made or the ideas are not investment worthy (poorly researched, biased to favour "clients").

Listen to People on The Front Line

Most of my most profitable ideas have been generated by taking the pulse of people with dirty boots - individuals and organizations involved directly in providing products and services to customers.

A much better approach is to listen to the people who make their living producing products and delivering the services in the "real world".

I discovered that it is far more profitable and beneficial to my portfolios ... and far more interesting than the formulaic bleatings of market analysts and the like.

Surveys

One of the most useful surveys is the Ag Economy Barometer which is managed by boffins at Purdue University.

The Ag Economy Barometer is the result of a collaboration between Purdue University’s Center for Commercial Agriculture and the CME Group to provide monthly nationwide measures of the health of the US agricultural economy. Together we believe this economic indicator underscores the importance of the agricultural economy and its participants – food producers and agribusinesses – to the overall U.S. and global economies. Purdue will analyze and report the result of each months’ Ag Economy Barometer value, which will be published the first Tuesday of every month....

The Barometer is unique because the index will be calculated based on producers’ sentiment about both current conditions and future expectations. Unlike other indices, the Ag Economy Barometer will also focus directly on key economic drivers US farm economy, including farm profitability, farmland values and key commodity prices and other seasonal drivers such as seed, fertilizer and feed ingredient prices. Each quarter, 100 agribusiness leaders will be surveyed to provide additional insight into the health of the ag economy. The barometer website features monthly releases and quarterly webinars.

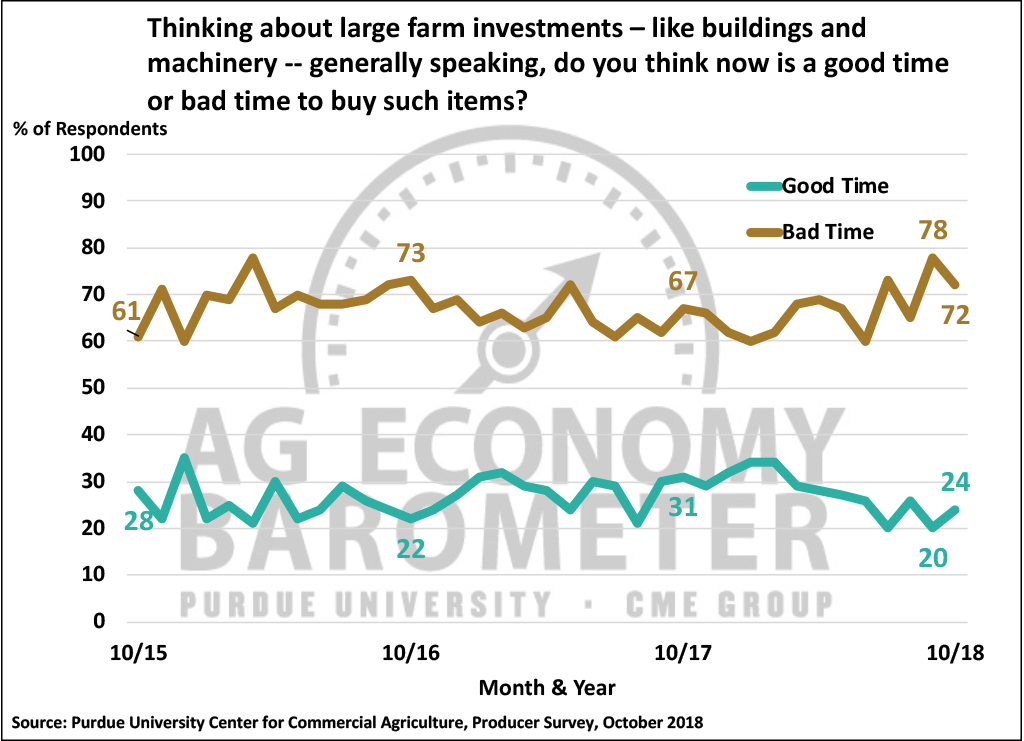

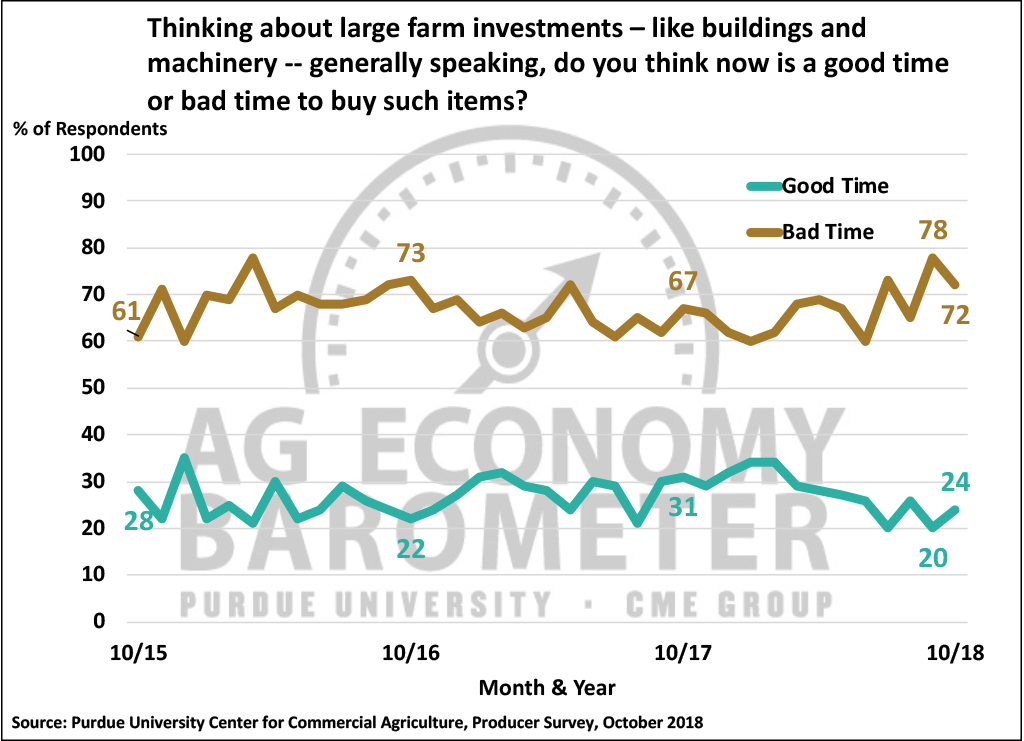

Here is an extract from the most recent Oct 2018 monthly report:

Surveys

One of the most useful surveys is the Ag Economy Barometer which is managed by boffins at Purdue University.

The Ag Economy Barometer is the result of a collaboration between Purdue University’s Center for Commercial Agriculture and the CME Group to provide monthly nationwide measures of the health of the US agricultural economy. Together we believe this economic indicator underscores the importance of the agricultural economy and its participants – food producers and agribusinesses – to the overall U.S. and global economies. Purdue will analyze and report the result of each months’ Ag Economy Barometer value, which will be published the first Tuesday of every month....

The Barometer is unique because the index will be calculated based on producers’ sentiment about both current conditions and future expectations. Unlike other indices, the Ag Economy Barometer will also focus directly on key economic drivers US farm economy, including farm profitability, farmland values and key commodity prices and other seasonal drivers such as seed, fertilizer and feed ingredient prices. Each quarter, 100 agribusiness leaders will be surveyed to provide additional insight into the health of the ag economy. The barometer website features monthly releases and quarterly webinars.

Here is an extract from the most recent Oct 2018 monthly report:

https://ag.purdue.edu/commercialag/ageconomybarometer/ag-barometer-rebounds-in-october/

This does not bode well for equipment sales, a combination of:

- low commodity prices

- higher input costs

- uncertainty about trade policy and the impact of competition from places such as Brazil and Argentina

You can subscribe to get free monthly reports via e-mail.

Regional Farm News Sources

I much prefer reading local/regional newspapers as they provide a more direct pipeline to local news than the major rags. They are very useful for assessing sentiment in the agricultural community. In this regard, I read periodicals that are sampled from a geographical cross-section of the US and Canada. I use Wikipedia as a starting point:

Farm Focused Publications

I visit a selection of these publications about once a month.

Government Reports

The Federal Reserve Bank provides some invaluable information about the state of agriculture in the US. You can subscribe to receive monthly reports on a variety of topics.

The US Department of Agriculture is a great source of information on a wide variety of topics. I often use the search function to to access detailed reports on topics ranging from research and science to crop production.

Concluding Remarks

- It takes time and effort to monitor these sources but after a while, you can get a sense of the community and develop a perspective which allows you to instinctively winnow out promising leads for investing.

- You will develop a new respect for farmers and the challenges that face them - also a sense of the products and services that will make a difference for them ... and why.

- It's always fun to learn new things. This knowledge broadens your perspectives - even to the point of making road trips more interesting as you start to gain an understanding of what is going on in the land traversed by the roads you are travelling.

No comments:

Post a Comment