Why?

There is a direct link between the proclivity of farmers to purchase equipment and their incomes. Farm incomes have cratered since 2013. The Federal Reserve Bank statistics for South Dakota are typical.

Trump's erratic actions have added to the uncertainty faced by farmers, especially for export markets.

In a previous post, I noted that farmers have been far more conservative in managing their budgets than in decades previous. As a result, they are generally more able to survive the present regime of low commodity prices and higher input costs. My belief is that they will have the wherewithal to make purchases when markets improve.

I started to investigate this thesis in more detail. A general pattern emerged.

Habits of a Financially Resilient Farmer

What sets a resilient farm apart from other growers? According to University of Illinois analysis, resilient farmers priorities are in order of importance, are:

- Pay attention to detail.

- Manage operating costs.

- Maximize yields.

- Be disciplined in spending.

- Use new technology.

Another observation is made later in the article:

Have the right equipment only for the operation, and maintain its condition.

In brief:

- Farmers are risk averse and trying just to get through the night.

- The great majority of farmers have "been there before" and have learned to manage their way through downturns in the agricultural cycle by managing expenditures carefully.

- There is increasing evidence that farmers are more willing to source their fertilizer and seeds from a variety of sources based on the best bang for the buck. I have the sense that this is less so for agricultural equipment as there remains a strong sense of brand loyalty, especially to the major brands such as Deere.

Where to From Here?

I expect that farm equipment makers and distributors will eventually do very well once the farm economy recovers. The "fleet" of farm equipment is getting aged and many farmers are at the balance point between trying to maintain the reliability of older equipment and purchasing new.

I will ignore the weekly gyrations in White House pronouncements as they are becoming irrelevant. Instead, I'll focus on longer term trends such as:

- demand in domestic and international markets

- the supply situation in exporting countries

- the state of commodity prices

- trends in farm income

- sentiment in farm communities (sometimes ignored because it takes so much work to read a plethora of local and regional sources)

One of the sources I use in this regard is farmdoc produced by the University of Illinois. It addresses many facets of farming in America.

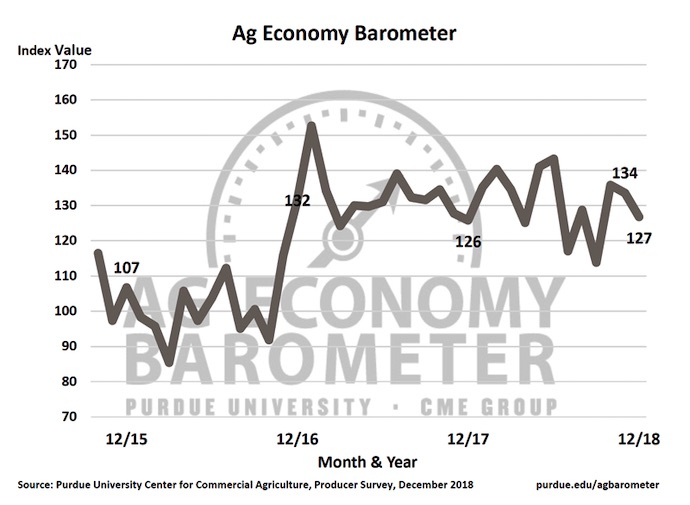

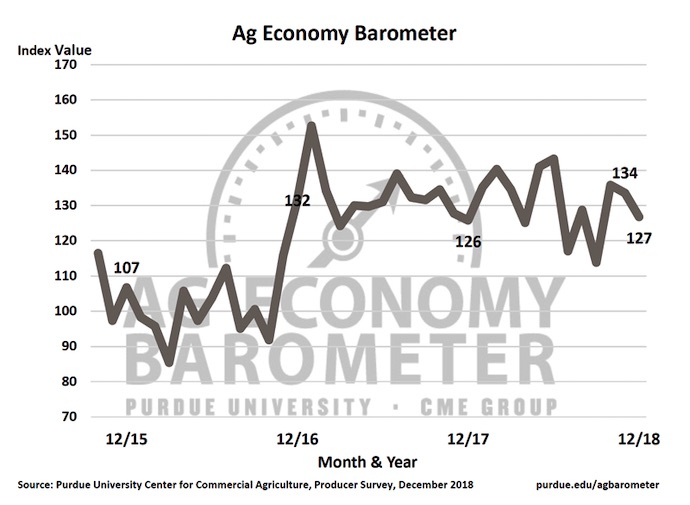

Another source is the The Purdue University/CME Group Ag Economy Barometer which monitors sentiment in the agricultural community. The key message from the most recent December survey is not great news for equipment manufacturers.

According to the report’s authors, Jim Mintert, director, and Michael Langemeier, associate director of Purdue University’s Center for Commercial Agriculture, December’s sentiment decline, compared to a month earlier, was attributable to producers’ perception that current economic conditions on their farms deteriorated, combined with reduced optimism about the future.

“When compared to a year earlier, however, producers’ perception of current conditions was markedly worse than in December 2017 as the Index of Current Conditions in December 2018 fell 30 points below the year ago level,” say the Purdue researchers. “In contrast, producers were actually more optimistic about the future in December 2018 than they were a year earlier as the Index of Future Expectations rose 15 points over the 12 month period. The weakening of farmer sentiment that took place from November to December appeared to impact farmers willingness to make large investments in their farming operations. The Large Farm Investment Index declined 5 points from November to December, which left it 9 points above the low established in September, but well below its year ago level.”

Another source is the The Purdue University/CME Group Ag Economy Barometer which monitors sentiment in the agricultural community. The key message from the most recent December survey is not great news for equipment manufacturers.

According to the report’s authors, Jim Mintert, director, and Michael Langemeier, associate director of Purdue University’s Center for Commercial Agriculture, December’s sentiment decline, compared to a month earlier, was attributable to producers’ perception that current economic conditions on their farms deteriorated, combined with reduced optimism about the future.

“When compared to a year earlier, however, producers’ perception of current conditions was markedly worse than in December 2017 as the Index of Current Conditions in December 2018 fell 30 points below the year ago level,” say the Purdue researchers. “In contrast, producers were actually more optimistic about the future in December 2018 than they were a year earlier as the Index of Future Expectations rose 15 points over the 12 month period. The weakening of farmer sentiment that took place from November to December appeared to impact farmers willingness to make large investments in their farming operations. The Large Farm Investment Index declined 5 points from November to December, which left it 9 points above the low established in September, but well below its year ago level.”

---------------------------------

My indicators are very simple - all based on what might lead a farmer to make a decision to buy.

There is no need to try and time the bottom as trends take time to express themselves, and once firmly established, they run for years.

Here is a brief listing of the companies I will consider buying when the signs align:

Rocky Mountain Equipment Dealerships Inc.

Deere and Company

Raven Industries Inc.

Ag Growth International Inc.

Titan Machinery

Agco Corp

These companies know how to manage during hard times. They have the following attributes:

- experienced management with a knowledge of their key markets

- fairly conservative balance sheets

- a commitment to investing in R&D

- excellent brand recognition and distribution systems

No comments:

Post a Comment