It was never about Europe. Brexit is Britain’s reckoning with itself

Brexit is just the vehicle by which a fractured state has come to realise that its politics are no longer fit for purpose....

It may seem strange to call this slow collapse invisible since so much of it is obvious: the deep uncertainties about the union after the Good Friday agreement of 1998 and the establishment of the Scottish parliament the following year; the consequent rise of English nationalism; the profound regional inequalities within England itself; the generational divergence of values and aspirations; the undermining of the welfare state and its promise of shared citizenship; the contempt for the poor and vulnerable expressed through austerity; the rise of a sensationally self-indulgent and clownish ruling class. But the collective effects of these interrelated developments do seem to have been barely visible within the political mainstream until David Cameron accidentally took the lid off by calling a referendum and asking people to endorse the status quo.

5 Hidden Ways That Globalization is Changing

A thought-provoking piece on the changing nature of globalization: something to think about when searching for and assessing potential investments.

Characteristics of Successful Farmers

Applicable to many areas of business. Something to look for when evaluating management when assessing potential investments.

Self-directed investing ... and thoughts about navigating through life ... always a beginner

Monday, 28 January 2019

Saturday, 26 January 2019

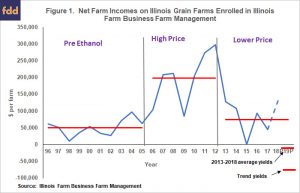

State of the Farm Economy

I continue to look for sources of information about the state of the farm economy with a view to trying to find an appropriate time to purchase stocks in agricultural equipment manufacturers and distribution companies. (See previous post for the list of potential companies.) My thesis is that equipment purchases will increase once farmers feel more optimistic. The key to this will be an increase in farm incomes. As mentioned in a previous posts, average farm incomes have declined by almost 50 percent since 20013. It is not generally appreciated just how dire things are:

https://www.agriculture.com/news/business/net-farm-income-expected-to-drop-12-this-year-usda-says

Read this for a comprehensive overview of the state of agriculture in America's agricultural heartland:

2019 Agricultural Outlook

No wonder that sales of farm equipment are stale.

A Few Useful Sources

I have expanded the list of my go-to sources of information about the state of the farm economy. There are two recent additions.

The Rural Mainstreet Index is supported by Creighton University. It is a treasure trove of information.

Survey Methodology

Each month, community bank presidents and CEOs in nonurban, agriculturally and energy-dependent portions of the 10-state area are surveyed regarding current economic conditions in their communities and their projected economic outlooks six months down the road. Bankers from Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming are included.

This survey represents an early snapshot of the economy of rural, agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy.

The Man Behind the Rural Mainstreet Index

Worth reading for context.

Here is a synopsis of the January 2019 survey results:

January Survey Results at a Glance:

· Overall index moves above growth neutral for the 11th time in past 12 months.

· More than four of 10 bank CEOs expect farm loan defaults to be biggest 2019 challenge.

· More than one third of bankers support the Federal Reserve holding on 2019 rate hikes.

· Only 22.9 percent, or slightly more than one in five, bankers reported expanding economic conditions in their area.

OMAHA, Neb. (Jan. 17, 2019): The Creighton University Rural Mainstreet Index for January fell, but remained above growth neutral, according to the monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy.

Some noteworthy observations:

"Our surveys over the last several months indicate the Rural Mainstreet economy is expanding outside of agriculture. However, the negative impacts of tariffs and low agriculture commodity prices continue to weaken the farm sector," said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University?s Heider College of Business.

The January farm equipment-sales index climbed to 40.9 from December?s 37.1. This marks the 65th consecutive month that the reading has remained below growth neutral 50.0.

The Creighton University web site is worth exploring as it provides an excellent window on taking the pulse of the community.

A few observations:

The CoBank

CoBank is one of the largest private providers of credit to the rural economy, delivering loans, leases and other financial services to agribusiness and rural infrastructure in all 50 states.

The Quarterly U.S. Rural Economic Review is interesting. The most recent one is entitled:

Agriculture Limps into 2019

Worth reading in its entirety.

https://www.agriculture.com/news/business/net-farm-income-expected-to-drop-12-this-year-usda-says

Read this for a comprehensive overview of the state of agriculture in America's agricultural heartland:

2019 Agricultural Outlook

No wonder that sales of farm equipment are stale.

A Few Useful Sources

I have expanded the list of my go-to sources of information about the state of the farm economy. There are two recent additions.

The Rural Mainstreet Index is supported by Creighton University. It is a treasure trove of information.

Survey Methodology

Each month, community bank presidents and CEOs in nonurban, agriculturally and energy-dependent portions of the 10-state area are surveyed regarding current economic conditions in their communities and their projected economic outlooks six months down the road. Bankers from Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming are included.

This survey represents an early snapshot of the economy of rural, agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy.

The Man Behind the Rural Mainstreet Index

Worth reading for context.

Here is a synopsis of the January 2019 survey results:

January Survey Results at a Glance:

· Overall index moves above growth neutral for the 11th time in past 12 months.

· More than four of 10 bank CEOs expect farm loan defaults to be biggest 2019 challenge.

· More than one third of bankers support the Federal Reserve holding on 2019 rate hikes.

· Only 22.9 percent, or slightly more than one in five, bankers reported expanding economic conditions in their area.

OMAHA, Neb. (Jan. 17, 2019): The Creighton University Rural Mainstreet Index for January fell, but remained above growth neutral, according to the monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy.

Some noteworthy observations:

"Our surveys over the last several months indicate the Rural Mainstreet economy is expanding outside of agriculture. However, the negative impacts of tariffs and low agriculture commodity prices continue to weaken the farm sector," said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University?s Heider College of Business.

The January farm equipment-sales index climbed to 40.9 from December?s 37.1. This marks the 65th consecutive month that the reading has remained below growth neutral 50.0.

The Creighton University web site is worth exploring as it provides an excellent window on taking the pulse of the community.

A few observations:

- The economy appears to be stuck in neutral ... rolling slightly forward, but at a snail's pace.

- The "Trump effect" has been decidedly negative.

- I noticed that one business has shifted its supplier from China to India. Is this the beginning of a wider trend?

The CoBank

CoBank is one of the largest private providers of credit to the rural economy, delivering loans, leases and other financial services to agribusiness and rural infrastructure in all 50 states.

The Quarterly U.S. Rural Economic Review is interesting. The most recent one is entitled:

Agriculture Limps into 2019

Worth reading in its entirety.

Wednesday, 23 January 2019

CO2 GRO - A Few Thoughts About Risk

In a previous post, I identified some potential risks:

GROW has great potential. However, there could be challenges:

Last night I decided to do some creative dreaming and set as an agenda item, GROW's risks. Here is what emerged.

GROW has great potential. However, there could be challenges:

- Difficulties with measures to protect its intellectual property

- The potential emergence of competitive technologies and applications

- Failure to secure regulatory approval for the use of CO2 Foliar Spray on cannabis plants in Canada - not a game ender as the technology can be used in other jurisdictions and for application on other high value crops

- It occupies a strategic sweet spot in an industry which is expanding rapidly.

- During "hard times" people are likely to continue with drinking and smoking weed.

- The medical use of cannabis is very likely to expand significantly.

----------------------------------

Not all risks are equal. I will start from least to most.

Failure to Secure Regulatory Approval from Health Canada for the use of CO2 Foliar Spray on Cannabis Plants

It is impossible to predict when/if approval will be given because it is not possible to ascertain with precision, the factors which may influence decision-making in Health Canada. As a former civil servant I was bemused on many occasions by decisions which come out of nowhere and which were created along logic paths foreign to most people.

However, continued inaction or a negative decision on the part of Health Canada is not a game changer. Fortunately, GROW has full rein to employ its technology in grow operations throughout the rest of the world: the market in Canada is a dime bag in comparison with the global market which marches along the lines of 100 kg bales.

Further, there is the great potential of Foliar Spray for high value leaf crops. I have a theory that controlled climate farming will become more important for a variety of reasons: reduced transportation and handling costs as production centres will be closer to markets; the reliability of output as compared to weather prone field production; the trend to lower operating costs given more efficient and cheaper inputs such as power and lighting.

Emergence of Competitive Technologies and Applications

There is no end to human ingenuity. Likely as not, there will be significant regulatory barriers to some innovations such as genetic engineering to enhance production and certain attributes, especially for foodstuffs. Other technologies such as root feeding and the like may involve higher costs or be more difficult to integrate with existing systems. All new technology will take time to diffuse within potential markets in the event that they are viable in certain circumstances.

I think that GROW's technology has an advantage in this scenario in that the range of potential applications for Foliar Spray is so diverse. It is very possible that a competitive technology will emerge that provides greater advantages to growers in certain scenarios and that it will outcompete GROW. However, GROW has a buffer in that it has exposure to many diverse markets (e.g. greenhouse produce and flowers, operations in shade shelters, hemp in open field operations etc.

Market Risk

Here I mean the combination of potentially adverse conditions in the demand for and revenue flows from GROW's technology and the reaction to these circumstances in the stock market. I don't worry much about this given that the technology will enhance the ability of growers to survive in tough times (e.g. the low risk contract offered by GROW). Further, during recessions, people generally don't leave their glasses on the table top. My bet is that the consumption of cannabis will not diminish either. I think that this stock is fairly recession resistant, especially if cash from new contracts starts to roll through the door.

Intellectual Property Theft

In my view, this is the greatest threat. There are jurisdictions where the rule of law does not prevail (e.g. China) in the sense that it is practiced elsewhere. There is every incentive for large companies in climate-challenged countries to poach technology with the potential to satisfy government apparatchiks and generate profits. (Again, China is a key concern.)

Further, GROW is small and has limited resources to challenge patent infringements.

Further, GROW is small and has limited resources to challenge patent infringements.

My hope is that full patent protection moves quickly but I don't pretend to know the in's and out's of protecting intellectual property.

This said, I think that one strategy for GROW to consider is signing a licensing agreement with a major multinational equipment manufacturer. An alliance of major manufacturer(s) with skin in the game and GROW would increase the legal muscle to fight potential infringements.

Other Remarks

As noted before, it's all about people. GROW's management and members of the Board of Directors have been "there" before and have practical experience in managing the in's and out's of emerging companies. Further, there is every expectation that the cast of characters will be on stage for tomorrow's show and many performances thereafter. This stability is important at this critical time.

I don't sense any difficulty in securing additional financing for GROW. With luck, it will soon be able to pay for future operations from income.

In sum, there's no too much that keeps me awake at night with this company. Time now to sit back and watch things unfold.

Monday, 21 January 2019

Portfolio Management - A Few Thoughts about Major Gains and Losses

Preface

A passage from Skin in the Game: Hidden Asymmetries in Daily Life by Nassim Nicholas Taleb caught my interest early one morning.

I personally know rich horrible poor forecasters and poor "'good" forecasters. Because what matters in life isn't how frequently one is "right" about outcomes, but how much one makes when one is right. Being wrong, when it isn't costly, doesn't count - in a way it's similar to the trial-and-error mechanisms of research.

In an earlier incarnation, I wrote a graduate thesis based on the "analysis of extremes", a method of understanding a phenomenon lacking parameters with a normal distribution of data. It led to insights that would not have been possible through the use of methods dependent on parametric data. I wondered if I could apply it to analyzing the performance of my portfolios.

Instead of looking at annual returns and averages over the longer term (a little more than 10 percent over 20 years without accounting for periodic withdrawals), I looked to discern the sources of major losses and gains.

Here is what I discovered.

For the purpose of this review, I defined "major contributors" as companies which increased in value by at least 250 percent. I paid no attention to the time period for the gain as at the end of the day, I am only interested in the final size of my stash.

A passage from Skin in the Game: Hidden Asymmetries in Daily Life by Nassim Nicholas Taleb caught my interest early one morning.

I personally know rich horrible poor forecasters and poor "'good" forecasters. Because what matters in life isn't how frequently one is "right" about outcomes, but how much one makes when one is right. Being wrong, when it isn't costly, doesn't count - in a way it's similar to the trial-and-error mechanisms of research.

In an earlier incarnation, I wrote a graduate thesis based on the "analysis of extremes", a method of understanding a phenomenon lacking parameters with a normal distribution of data. It led to insights that would not have been possible through the use of methods dependent on parametric data. I wondered if I could apply it to analyzing the performance of my portfolios.

Instead of looking at annual returns and averages over the longer term (a little more than 10 percent over 20 years without accounting for periodic withdrawals), I looked to discern the sources of major losses and gains.

Here is what I discovered.

- Major gains in the value of the portfolios were due largely to the outstanding performance of a few investments.

- Major losses were attributable to a general decline in the market as a whole - not outsized losses due to the poor performance of a few individual investments.

This was eye-opening. It led me to question previous assumptions about the basics of portfolio management; namely,

- the benefits of diversification in order to distribute risk more evenly

- and correspondingly, the optimum number of holdings in a portfolio (20 to 30 are often cited as being ideal)

- the dictum of buying and holding through thick and thin (the thesis is that long-term trend in the market, when measured over decades, is always "up")

- the convention that one should limit the size of an individual holding to no more than 5 percent of a portfolio and then "rebalance"

The academic literature and convention that I had accepted as gospel simply did not hold up in the light of my practical experience.

A few other considerations that may have influenced the review:

A few other considerations that may have influenced the review:

- In recent years, the composition of the portfolio has been biased in favour of companies in the early stages of development and other small to medium cap stocks.

- Since the major portfolio is not tax sheltered, there is a bias to investing for capital gains.

- The number of holdings has declined steadily.

- In the last two years, my strategy of heeding market cycles may have influenced performance but it's still to soon to determine its impact on performance over the longer term.

Observations About Major Contributors

For the purpose of this review, I defined "major contributors" as companies which increased in value by at least 250 percent. I paid no attention to the time period for the gain as at the end of the day, I am only interested in the final size of my stash.

1. Catching the Trend - The Strategic Sweet Spot

Virtually all of the major gainers were companies that operated in a strategic sweet spot - a sector experiencing significant growth.

The first major gains were associated with precious metals. As a result of investing in a few companies and letting gainers run, some portfolios experienced gains of almost 40 percent and 30 percent in two consecutive years.

The second set of investments which produced major gains were in the oil and gas sector at a time when commodity prices were increasing significantly.

2. Portfolio Concentration

During the periods when I invested in "sweet spot" companies, the portfolios were concentrated. As to the risk associated with this, I reasoned that when things started to go south, I would exit my positions. I didn't worry too much about trying to time the exits as I had the cushion of healthy profits. (I remember showing one of the portfolios to a tax expert and he expressed the view that it was "risky" and unorthodox, ignoring the reason that it was brought to his attention because of the gains it had made. )

3. Innovative Business Models

Many of the companies had innovative business models which gave them a competitive edge. The foray into Silver Wheaton, one of the first precious metals streaming companies, alerted me to the possibilities of investing in companies with new business models. Abitibi Royalties is another company with an interesting model - a perpetual lottery based on bets on properties associated with major gold camps.

4. Great Balance Sheets

For the most part the companies had sound financials. Most of the companies had very low or no debt. Some did not have cash flows from operations in the initial going but were able to secure financing through a variety of means because the business was attractive.

5. Patience on my Part

Questor Technologies was a great learning experience. Following my initial investment, the price declined by more than 50 percent. However, I had faith in the company's management - truly outstanding - and the state of its finances. I also felt that the company was in a strategic sweet spot. I added to my stake as the company achieved various milestones - a lesson that I applied ever since - most recently to CO2 GROW and Abitibi Royalties and Clean Seed Capital.

6. The Over-Riding Importance of Great Management with Muddy Boots

All of the major gainers had management with the following characteristics: a strong sense of ethics, mindful of the interests of shareowners, adaptability to meet changing circumstances, and a careful hand to company finances.

Most important, however, was that leadership was provided by management with the direct experience of managing business activities within the sector - an understanding of how things work and a great network used to get things done efficiently. Clean fingernails maybe. Muddy boots always.

I always checked the pedigrees of management to assess their previous performance. Surprisingly, many of them came up through the ranks of their sector. (More on pedigrees later on.)

The profitability of some companies (e.g. Questor) rose significantly when adjustments were made to the business model. It is a credit to management's agility and its approach to astute risk taking in addressing business challenges.

The profitability of some companies (e.g. Questor) rose significantly when adjustments were made to the business model. It is a credit to management's agility and its approach to astute risk taking in addressing business challenges.

7. Hard Work and a Bit of Luck on My Part

All of the major contributors were found by extensive reading. Hardly any of the reading involved the financial media. Instead, I read local and regional newspapers, and trade journals, and the output of a few well-regarded think tanks - this in addition to technical papers in order to gain an understanding of the sector.

Lady Luck played a role ... I'll never know the contribution of LL to the performance of the portfolio. Always nice to have as a partner.

All of the major contributors were found by extensive reading. Hardly any of the reading involved the financial media. Instead, I read local and regional newspapers, and trade journals, and the output of a few well-regarded think tanks - this in addition to technical papers in order to gain an understanding of the sector.

Lady Luck played a role ... I'll never know the contribution of LL to the performance of the portfolio. Always nice to have as a partner.

Observations About Major Losses

For the purpose of this discussion, I define the category as positions that lost more than 75 percent of their value from the time of purchase. The one exception is point #4 below.

1. Management Not up to the Task of Running the Business

One company had on its board, a person who was convicted of doing bad things. What sort of a company would associate with characters like this? You are known by the company you keep. How was this reflected in the way the company conducted its business? A lesson learned.

Another company had a serial failure artist as its leader - a person who managed to move on to the next company by virtue of his connections. He engaged in questionable business practices and orchestrated things to ensure that he was paid beyond reason ... to the detriment of the company and its shareowners.

Both of the aforementioned companies were led by people without muddy boots - individuals lacking a practical knowledge of the "trade" and the subtleties of competing successfully by delivering meaningful products and services at good prices.

2. Weak Finances

You cannot run a company on the fumes of lit candles and censers. The devil is in the details ... in this case .... cash.

Two of the companies ran out of cash and were constrained in their efforts by the difficulty of securing additional funding. Others were burdened by heavy debt loads which left them vulnerable to the inevitable setbacks that plague all companies from time to time.

3. Poor Strategic Positioning

I lost almost all of my stake in a few companies in the oil and gas sector in Canada. I failed to account for the rise of fracking and the lack of capacity to move products to distant refineries. It was akin to the "boiling frog" syndrome: external factors gradually exerted more and more influence. I succumbed to the temptation to downplay them with the thought that "my" companies could adjust. They didn't - the frog was "done".

It was a lesson learned. That is why I exited from agricultural machinery manufacturers and distributors over the past two years. An important fact: farm incomes in the US are about half of what they were in 2013. No wonder that farmers are reluctant to buy new machinery.

4. General Downturn in the Market

This was THE major reason for significant losses. All holdings, regardless of their merits, headed south in 2008. It was painful - a combined loss of more than 30 percent.

I resolved to make every effort to avoid this in the future. As a result, the most recent downturn in 2018 restricted losses to 2 percent across of our portfolios.

I have a special place in my heart for Howard Marks. Mastering the Market Cycle has pride of place on my bookshelf. (The row has been winnowed to only five books.)

Contrary to the advice proffered by academics and money managers, my experience has been that it is possible to time the market within reason. We do it every day. When it rains, we go inside or put up our umbrellas. Why should it be any different with investments? As professional money managers would have it, we should tolerate getting wet in the occasional shower with the rationale that we will eventually dry out ... and they still collect their fees while watching us get soaked or while hanging us out to dry.

5. Following the Herd

A few of the losses were generated by investments that I made on the basis of suggestions from others - tips. In some instances, I did not understand the business or take the time to undertake due diligence. I relied on the credentials of the source. Never again. I prefer to take responsibility for my mistakes and to have a greater chance of learning from them.

Concluding Remarks

For the purpose of this discussion, I define the category as positions that lost more than 75 percent of their value from the time of purchase. The one exception is point #4 below.

1. Management Not up to the Task of Running the Business

One company had on its board, a person who was convicted of doing bad things. What sort of a company would associate with characters like this? You are known by the company you keep. How was this reflected in the way the company conducted its business? A lesson learned.

Another company had a serial failure artist as its leader - a person who managed to move on to the next company by virtue of his connections. He engaged in questionable business practices and orchestrated things to ensure that he was paid beyond reason ... to the detriment of the company and its shareowners.

Both of the aforementioned companies were led by people without muddy boots - individuals lacking a practical knowledge of the "trade" and the subtleties of competing successfully by delivering meaningful products and services at good prices.

2. Weak Finances

You cannot run a company on the fumes of lit candles and censers. The devil is in the details ... in this case .... cash.

Two of the companies ran out of cash and were constrained in their efforts by the difficulty of securing additional funding. Others were burdened by heavy debt loads which left them vulnerable to the inevitable setbacks that plague all companies from time to time.

3. Poor Strategic Positioning

I lost almost all of my stake in a few companies in the oil and gas sector in Canada. I failed to account for the rise of fracking and the lack of capacity to move products to distant refineries. It was akin to the "boiling frog" syndrome: external factors gradually exerted more and more influence. I succumbed to the temptation to downplay them with the thought that "my" companies could adjust. They didn't - the frog was "done".

It was a lesson learned. That is why I exited from agricultural machinery manufacturers and distributors over the past two years. An important fact: farm incomes in the US are about half of what they were in 2013. No wonder that farmers are reluctant to buy new machinery.

4. General Downturn in the Market

This was THE major reason for significant losses. All holdings, regardless of their merits, headed south in 2008. It was painful - a combined loss of more than 30 percent.

I resolved to make every effort to avoid this in the future. As a result, the most recent downturn in 2018 restricted losses to 2 percent across of our portfolios.

I have a special place in my heart for Howard Marks. Mastering the Market Cycle has pride of place on my bookshelf. (The row has been winnowed to only five books.)

Contrary to the advice proffered by academics and money managers, my experience has been that it is possible to time the market within reason. We do it every day. When it rains, we go inside or put up our umbrellas. Why should it be any different with investments? As professional money managers would have it, we should tolerate getting wet in the occasional shower with the rationale that we will eventually dry out ... and they still collect their fees while watching us get soaked or while hanging us out to dry.

5. Following the Herd

A few of the losses were generated by investments that I made on the basis of suggestions from others - tips. In some instances, I did not understand the business or take the time to undertake due diligence. I relied on the credentials of the source. Never again. I prefer to take responsibility for my mistakes and to have a greater chance of learning from them.

Concluding Remarks

- It is useful to look at portfolio performance with a new perspective - one that goes beyond the usual monthly, yearly outlook.

- I was able to detect some identifiable patterns and hope that I will incorporate the lessons learning in future investment activity.

Friday, 18 January 2019

C02 GRO Inc. and Abitibi Royalties - Recent Developments

Recent developments with CO2 GRO and Abitibi Royalties Inc. led me to increase the size of my holdings.

Abitibi Royalties Inc.

It looks as if Abitibi's hopes for a royalty flow from Canadian Malartic are being realized. This is a game changer.

VAL-D’OR, Québec, Jan. 16, 2019 (GLOBE NEWSWIRE) -- Abitibi Royalties Inc. (RZZ-TSX-V, ATBYF-OTC-Nasdaq Intl: “Abitibi Royalties” or the “Company”) is pleased to announce that production commenced at the end of Q4-2018 in the area covered by the Company’s 3% net smelter royalty (“NSR”) at the Canadian Malartic Mine near Val-d’Or Québec (Fig. 1). Canadian Malartic is the largest gold mine in Canada and is operated by Agnico Eagle Mines Limited and Yamana Gold Inc.

https://www.abitibiroyalties.com/news/2019/january16/

CO2 GRO

Recently, I contacted Sam Kanes, VP of Business Development, in order to learn more about the company's business model and its technology. By way of a follow-up to the conversation, he sent me three recently-posted documents:

CO2 Foliar Spray Executive Summary

CO2 GRO Foliar Spray Technology

CO2 GRO Inc. January 2019 Corporate Presentation

The documents can be accessed here:

Presentations January 2019

After some reflection, I was left with the following impressions:

GROW is amenable to negotiating agreements with major equipment manufacturers and suppliers of CO2 for the use of its technology (Sam Kanes, personal communication, January 20, 2019). This is attractive as it could represent a significant value add to equipment manufacturers or suppliers of CO2 and add nicely to GROW's bottom line - a balance of mutual benefits.

GROW continues to make inroads into the greenhouse industry. This will take time as the agricultural community is understandably cautious about accepting new technologies. One of the reasons why the Civilian Conservation Corps was so successful in improving agricultural practices in the 1930's in the US was that it understood this "show me first" attitude and fielded many demonstration areas for farmers to see things for themselves. It appears that GROW understands this mindset. The power of story telling is underestimated ... and it involves far more than testimonials.

The cannabis industry may be a bit more open to adopting GROW's technology because it enhances desirable characteristics such as the THC and CBD content in buds and increases growth rates significantly in a high value crop, thereby increasing financial returns on a per unit area basis. Further, the technology is cheaper than traditional CO2 gassing, the current method used to enhance growth in cannabis operations in greenhouses.

The catalyst for this potential bonanza will be approval by Health Canada for the use of CO2 Foliar Spray on cannabis plants. Health Canada gave approval for it use on other plants for human consumption such as lettuce in Q3 2018. However, for political reasons, the agency is more cautious in its approach to cannabis. Apparently, the prohibition of CO2 Foliar Spray on vegetative and and flowering room growth applies only to Canada. Does this place Canadian producers at a competitive disadvantage or will it drive producers to other jurisdictions all things being equal? The heartening thing is that GROW's technology can be used anywhere.

Another catalyst could be Health Canada's approval for the use of CO2 Foliar Spray on plant cuttings to enhance root formation, starting in 2019.

Another market for GROW is the hemp industry. Recent federal legislation in the U.S. has eased restrictions on the growing of hemp provided the THC content is less than 0.3 percent. The legislation is subject to variation by state. Here is a synopsis:

State Industrial Hemp Statutes

For the more technically minded, here is the link to the US Patent Office for US Patent 6,209,855 Gas/liquid mixing apparatus and method, the core technology for GROW.

Potential Headwinds

GROW has great potential. However, there could be challenges:

----------------------------------------------------

A Note about Innovation

Human ingenuity never fails to amaze me:

Abitibi Royalties Inc.

It looks as if Abitibi's hopes for a royalty flow from Canadian Malartic are being realized. This is a game changer.

VAL-D’OR, Québec, Jan. 16, 2019 (GLOBE NEWSWIRE) -- Abitibi Royalties Inc. (RZZ-TSX-V, ATBYF-OTC-Nasdaq Intl: “Abitibi Royalties” or the “Company”) is pleased to announce that production commenced at the end of Q4-2018 in the area covered by the Company’s 3% net smelter royalty (“NSR”) at the Canadian Malartic Mine near Val-d’Or Québec (Fig. 1). Canadian Malartic is the largest gold mine in Canada and is operated by Agnico Eagle Mines Limited and Yamana Gold Inc.

https://www.abitibiroyalties.com/news/2019/january16/

CO2 GRO

Recently, I contacted Sam Kanes, VP of Business Development, in order to learn more about the company's business model and its technology. By way of a follow-up to the conversation, he sent me three recently-posted documents:

CO2 Foliar Spray Executive Summary

CO2 GRO Foliar Spray Technology

CO2 GRO Inc. January 2019 Corporate Presentation

The documents can be accessed here:

Presentations January 2019

After some reflection, I was left with the following impressions:

- The company is making significant progress in demonstrating in a rigorous way, the benefits of its technology in real world situations.

- The technology provides a definitive, quantifiable benefit to commercial growers of high value crops.

- GROW's business model "de-risks" to a major degree, the uncertainties of adopting the technology - something which should hasten the rate of adoption by growers.

- The technology can be integrated easily with most existing overhead irrigation systems.

- GROW has narrowed its focus and is proceeding to develop agreements within major target markets.

- The technology is applicable to a variety of high value crops and growing situations (e.g. enclosed greenhouses, canopy-type greenhouses, open fields). This adaptability is a decided advantage as the company's future is not tethered to satisfying the needs of a narrow market.

- GROW is active in the U.S hemp industry

GROW is amenable to negotiating agreements with major equipment manufacturers and suppliers of CO2 for the use of its technology (Sam Kanes, personal communication, January 20, 2019). This is attractive as it could represent a significant value add to equipment manufacturers or suppliers of CO2 and add nicely to GROW's bottom line - a balance of mutual benefits.

GROW continues to make inroads into the greenhouse industry. This will take time as the agricultural community is understandably cautious about accepting new technologies. One of the reasons why the Civilian Conservation Corps was so successful in improving agricultural practices in the 1930's in the US was that it understood this "show me first" attitude and fielded many demonstration areas for farmers to see things for themselves. It appears that GROW understands this mindset. The power of story telling is underestimated ... and it involves far more than testimonials.

The cannabis industry may be a bit more open to adopting GROW's technology because it enhances desirable characteristics such as the THC and CBD content in buds and increases growth rates significantly in a high value crop, thereby increasing financial returns on a per unit area basis. Further, the technology is cheaper than traditional CO2 gassing, the current method used to enhance growth in cannabis operations in greenhouses.

The catalyst for this potential bonanza will be approval by Health Canada for the use of CO2 Foliar Spray on cannabis plants. Health Canada gave approval for it use on other plants for human consumption such as lettuce in Q3 2018. However, for political reasons, the agency is more cautious in its approach to cannabis. Apparently, the prohibition of CO2 Foliar Spray on vegetative and and flowering room growth applies only to Canada. Does this place Canadian producers at a competitive disadvantage or will it drive producers to other jurisdictions all things being equal? The heartening thing is that GROW's technology can be used anywhere.

Another catalyst could be Health Canada's approval for the use of CO2 Foliar Spray on plant cuttings to enhance root formation, starting in 2019.

Another market for GROW is the hemp industry. Recent federal legislation in the U.S. has eased restrictions on the growing of hemp provided the THC content is less than 0.3 percent. The legislation is subject to variation by state. Here is a synopsis:

State Industrial Hemp Statutes

For the more technically minded, here is the link to the US Patent Office for US Patent 6,209,855 Gas/liquid mixing apparatus and method, the core technology for GROW.

Potential Headwinds

GROW has great potential. However, there could be challenges:

- Difficulties with measures to protect its intellectual property

- The emergence of competitive technologies and applications

- Failure to secure regulatory approval for the use of CO2 Foliar Spray on cannabis plants in Canada - not a game ender as the technology can be used in other jurisdictions and for application on other high value crops

- It occupies a strategic sweet spot in an industry which is expanding rapidly.

- During "hard times" people are likely to continue with drinking and smoking weed.

----------------------------------------------------

A Note about Innovation

Human ingenuity never fails to amaze me:

- the imagination and so-called "surprises" on the part of researchers which leads to new discoveries; and,

- the genius on the part of entrepreneurs for connecting these discoveries to practical applications and the building of businesses.

At one time, I was interested in developing and selling the "ultimate" outdoors shirt. I still feel that the current crop falls far short of the "ideal" garment. As part of my background research, I came across a wonderful source: TechLink

The Department of Defense has approximately 120 labs and research facilities nationwide, involving the Air Force, Army, Navy, and specialized agencies such as the National Security Agency. Defense TechLink has facilitated partnerships with most of these centers, linking them with private industry for technology licensing, transfer, and joint R&D. TechLink is a US Department of Defense Partnership Intermediary per Authority 15 USC 3715.

Companies of All Sizes

We assist companies ranging in size from one-person start-ups to Global 100 corporations. Most have fewer than 100 employees. Through TechLink-assisted partnerships, companies can access new DoD inventions, greatly leverage their R&D investments, and more successfully develop and commercialize new technologies.

About once a year, I visit the site to see what's on offer. It's a gold mine of ideas. And my bet is that getting rights to use the technology is far easier and faster than trying to wrestle with university commercialization offices and the politics of academia. I once heard that the reason why academics give no quarter in their debates is because the stakes are so low. Some have difficulty in leaving this mindset behind when confronted by the realities of the outside world, but this is changing quickly. Universities are now vital contributors to innovation. One need only check the distribution of new patents and new business formation. Overwhelmingly, they originate within cities and towns blessed with the presence of one or more universities. GROW is but one example.

Saturday, 12 January 2019

The Financial Log Book - Performance 2018

When reviewing the performance of portfolios, I always look at the previous year's performance. Why?

* Prices are quoted in the currency of the exchanges where equities are listed. As a result the gain/loss is not an accurate measure of the performance of the portfolio as the $US has risen significantly against the $=Cdn since many US positions were established.

** Gain/Loss exclusive of dividends

Relative weightings of holdings in the portfolio when the position was first established:

H = >9%

M = 5-9%

L = <5%

Other Observations

Others

Fairfax India Holdings is another core holding for two main reasons: the quality of its management; and, the economic potential of India. The country has "better bones" than China: a more attractive demographic profile; an amazing ability to accommodate a bewildering variety of ethnicities, languages and religions; a democracy; a society governed by the rule of law; a new confidence and a trend in government which is more amenable to the growth of private enterprise. An aside: I've become interested in reading Indian newspapers: they are irreverent, opinionated, revel in the peccadillos of characters in the public limelight ... and at the same time, host some excellent thinkers who express themselves with elegance.

Questor Technologies is a wonderful company lead by an outstanding President. The depressed state of the oil and gas industry has soured investor sentiment but Questor has been there before and is well positioned to do well when things start to recover.

A Look Ahead

A climate of uncertainty dominates the markets:

From time to time, I will make short-term speculative bets on turns in the market through the use of leveraged reverse index funds. However, they will be used sparingly.

My cash position is now in the vicinity of 50 percent. I've learned to conserve my stash and employ it to good effect when valuations and opportunities are attractive ... and usually this is when market participants are most reluctant to invest.

I am also exploring the notion of "rebound kings" - companies that may do extremely well when things improve. In addition to outstanding leadership and products, a few characteristics may include: great financials with little debt; the ability to ramp up production quickly; great distribution networks; profitability at present. This will be explored over the coming months.

ps

If there are any discrepancies in the accounting in The Financial Log Book, it is the result of my distain for clerical/accounting-type work. In my early days I was given an aptitude test which presented one with a series of 60 questions and compared the results with answers provided by people who had been successful in various lines of work. I was not surprised when I recorded a score of 4 out of 60 for clerical work and policing. On the other hand, I was close to a score of 60 for the following occupations: minister, librarian and concert musician. How ever did I end up as a geographer and finally end my wage earning career in the research sector? Life and investing - an adventure.

- It provides a learning opportunity: to see what might have happened if decisions to sell were not made - also, to test one's reasoning on the basis of subsequent events.

- It sets up a mental space for reviewing the performance of the following year: is there any consistency in the pattern behind decision-making for gainers and decliners? (Note that I've stopped using the word "winners" as some companies take more than a few years for their value to be recognized in the market).

Performance for 2017

| Entity |

Wt

| Initial Price/ Purchase * Date | Price * Nov 6/17 | Gain/Loss since Jan 1/17 % | Gain/Loss** Since Purchase % |

|---|---|---|---|---|---|

Wheaton Precious Metals (WPM) (formerly Silver Wheaton)

|

H

|

12.37

2007-09-04

|

26.71

|

4.2

|

213.2

|

| Polaris Materials Corporation (PLS) SOLD |

L

|

10.70

2007-06-01

|

SOLD

2017-08-01 |

- 92

| |

| Cenovus (CVE) SOLD |

M

|

32.39

2010-07-27

|

SOLD

2017-08-24 |

- 69

| |

| North West Company (NWF) SOLD |

H

|

16.23

2009-05-07

|

SOLD

2017-08-11 |

30.37

| |

| Deere & Company (DE) SOLD |

H

|

88.07

2013-01-03

|

SOLD

2017-08-01 |

45.4

| |

| Rocky Mountain Dealerships (RME) SOLD |

H

|

11.89

2013-01-03

|

SOLD

2017-08-22 |

-6.4

| |

| Oaktree Capital Group (OAK) |

M

|

56.45

2013-10-28

|

43.75

|

24.5

|

-22.50

|

| Fairfax Financial Holdings (FFH) SOLD |

H

|

477.98

2014-3-25

|

SOLD

2017-03-08 |

30.5

| |

| Clean Seed Capital (CSX) |

M

|

.51

2015-01-07

|

0.47

|

30.7

|

-7.84

|

| Abitibi Royalties (RZZ) |

M

|

2.57

2015-11-20

|

8.05

|

-0.70

|

212.2

|

| Fairfax India Holdings Corp (FIH.U) |

H

|

10.42

2015-12-16

|

15.57

|

34.8

|

49.42

|

| CRH Medical Corp (CRH) SOLD |

M

|

4.43

2105-12-29

|

SOLD

2017-03-2 |

138.8

|

** Gain/Loss exclusive of dividends

Relative weightings of holdings in the portfolio when the position was first established:

H = >9%

M = 5-9%

L = <5%

I sold several positions for a variety of reasons:

- a sense that the markets were getting over extended;

- a belief that one never gets poor by taking profits;

- a belief that some sectors had poor prospects (e.g. oil and gas); and,

- a determination that some companies were poorly managed e.g. Polaris (the loss was taken as a lesson to be applied elsewhere ... the company consistently failed to achieve its milestones)

- a belief in the business model and company management e.g. Abitibi Royalties; and,

- a sense that the company's best years lay ahead as a result of its strategic positioning and it's superior products/services. I invested in nascent enterprises such as Clean Seed with a 5 - 10 time horizon and the view that it would take years for the company to realize its potential.

- Note that I have not included a figure for the performance of the portfolio as a whole. Figures such as this are only "relevant" for portfolios managed by those with clients. Why assess performance on such an arbitrary time period? There is no rationale other than for marketing reasons or determining annual bonuses for portfolio managers. Individual investors have the luxury of not having to adhere to this dictum. When assessing the performance of portfolios, I am more concerned with trends in the state of my "stash" as measured by the performance of its parts using weeks/months/years - whatever measure is most appropriate at the time for the long-term well-being of my portfolio.

- In examining the performance of positions after they were sold, I felt fairly pleased as most declined thereafter. However, I really blew the call for Deere as it made substantial gains thereafter ... but then again I still made a profit.

- I believe that it is possible to time the market and have read extensively on the subject, especially the writings of Howard Marks e.g. Mastering the Market Cycle. By trimming positions in 2017 and later on it 2018 for holdings not mentioned in the Financial Log Book, I missed most of the downturn in the market in 2018. It was a lesson learned from my experience in 2007/08. Unfortunately many large institutional investment managers do not have the luxury of being able to stage strategic retreats when market conditions are inimical, hence the dictum of "buy and hold".

- Note: the performance for Silver Wheaton is understated since the original purchase was made long before the start of the blog and the newsletter which it replaced. Also, it does not reflect additions to the original position once the stock started to roll.

Performance for 2018 and early 2019

| Entity |

Wt

|

Initial Price/ Purchase * Date | Price * Jan 11/19 |

Gain/Loss** Since Purchase % |

|---|---|---|---|---|

Wheaton

Precious Metals (WPM) (formerly Silver Wheaton)

|

H

|

12.37

2007-09-04

|

26.63

|

107.36

|

| Oaktree Capital Group (OAK) |

M

|

56.45

2013-10-28

|

40.83

|

-27.7

|

| Clean Seed Capital (CSX) |

M

|

.51

2015-01-07

|

0.4

|

-22.5

|

| Questor Technologies Inc. (QST) |

L

|

1.74

2015-05-22

|

4.19

|

140.8

|

| Abitibi Royalties (RZZ) |

M

|

2.57

2015-11-20

|

9.51

|

270

|

| Fairfax India Holdings Corp (FIH.U) |

H

|

10.42

2015-12-16

|

13.46

|

29.2

|

| CO2 Grow Inc. (GROW) |

L

|

.15

2018-12-18

|

0.23

|

40.6

|

*

Prices are quoted in the currency of the exchanges where

equities are listed. As a result the gain/loss is not an

accurate measure of the performance of the portfolio as the $US has

risen significantly against the $=Cdn since many US positions were

established.

**

Gain/Loss exclusive of dividends and increases to the original position.

Relative

weightings of holdings in the portfolio when the position was first

established:

H

= >9%

M

= 5-9%

L

= <5%

Introductory Remarks

In the last two years investing took a second seat to other interests e.g. a new piano and the wonders of B&B (Beethoven and Bach); more travel and time with friends and family. The flow of new ideas diminished and as a result, there were fewer new positions established. By the of 2018, almost 55 percent of my portfolio was in cash.

Since the end of the sailing, I have renewed the hunt for new investments, starting with a special focus on agriculture (see previous posts on potential companies and the state of the farm machinery manufacturing and distribution sector).

Agricultural Holdings

Clean Seed Capital is a nascent enterprise. Although it has achieved some noteworthy milestones (establishment of a manufacturing capability and a distribution network in Canada and the U.S., and increased awareness on the part of farmers) its progress has been dampened by the depressed state of the agricultural sector. The major test will be its ability to generate sales once farmers' incomes improve. There is the possibility that Clean Seed will be taken over by a larger company. The changing composition of the Board of Directors may be an indication of this.

CO2 GROW has been a nice surprise. I expect that the price of the stock will be volatile, especially given investors' attitudes to betting on the cannabis industry. In the "early days" first entrants had a clear competitive advantage due solely to their ability to get permits for production. With the entry of more competitors, the industry will be driven more by a quest for greater efficiency. If GROW secures regulatory approval for the use of its product on cannabis, investor interest will increase significantly. (In correspondence with management, I was informed that the company's technology would be applied only during the pre-flowering stage. Will this increase the odds of regulatory approval?

Precious Metals

Abitibi Royalties is a core holding for three reasons: quality of its management; a business model with the potential to generate tremendous flows of cash in the event that some of its properties are developed as operating mines (especially Abitibi's interests in Canadian Malarctic); and, the possibility that gold prices will increase.

Others

Fairfax India Holdings is another core holding for two main reasons: the quality of its management; and, the economic potential of India. The country has "better bones" than China: a more attractive demographic profile; an amazing ability to accommodate a bewildering variety of ethnicities, languages and religions; a democracy; a society governed by the rule of law; a new confidence and a trend in government which is more amenable to the growth of private enterprise. An aside: I've become interested in reading Indian newspapers: they are irreverent, opinionated, revel in the peccadillos of characters in the public limelight ... and at the same time, host some excellent thinkers who express themselves with elegance.

Questor Technologies is a wonderful company lead by an outstanding President. The depressed state of the oil and gas industry has soured investor sentiment but Questor has been there before and is well positioned to do well when things start to recover.

A Look Ahead

A climate of uncertainty dominates the markets:

- Major geopolitical shifts are underway: potential of Brexit; competition between China and the US; continued strife in the Middle East; the spectre of Russian interference; etc.

- For better or worse, Trump has had a very unsettling impact due to his unpredictability and impetuous pronouncements which have had to be walked back in the face of reality etc. The impact of his regime on agricultural exports and the farm machinery industry will be especially interesting to monitor. A relaxation of the trade war will not, of its own, clear the runway for a liftoff in agriculture stocks as there always remains the prospect of a meltdown in the broader economy. I am prepared to wait for the "all clear" signals and will likely ease my way into the market as opportunities present themselves. It's all about farm incomes and farmers' perception of the future.

- Some "safe haven" positions in precious metals will be maintained and with Abitibi, there is the prospect of notable gains if mine expansion at Malarctic involves areas where Abitibi has an interest.

From time to time, I will make short-term speculative bets on turns in the market through the use of leveraged reverse index funds. However, they will be used sparingly.

My cash position is now in the vicinity of 50 percent. I've learned to conserve my stash and employ it to good effect when valuations and opportunities are attractive ... and usually this is when market participants are most reluctant to invest.

I am also exploring the notion of "rebound kings" - companies that may do extremely well when things improve. In addition to outstanding leadership and products, a few characteristics may include: great financials with little debt; the ability to ramp up production quickly; great distribution networks; profitability at present. This will be explored over the coming months.

ps

If there are any discrepancies in the accounting in The Financial Log Book, it is the result of my distain for clerical/accounting-type work. In my early days I was given an aptitude test which presented one with a series of 60 questions and compared the results with answers provided by people who had been successful in various lines of work. I was not surprised when I recorded a score of 4 out of 60 for clerical work and policing. On the other hand, I was close to a score of 60 for the following occupations: minister, librarian and concert musician. How ever did I end up as a geographer and finally end my wage earning career in the research sector? Life and investing - an adventure.

Friday, 11 January 2019

Noteworthy Reads 2 - January 2019

The Dystopian View - Is This the Year the World Falls Apart?

"The geopolitical environment is the most dangerous it's been in decades," warns Eurasia Group, political risk-adviser to the world's elites, and a voice of globalist ideology.

The Henley Passport Index

The index ranks passports in terms of how many countries holders can access without visas. While interesting, the real gold is in the following report: Henley Passport and Global Mobility Report

There are gems like this:

The increasingly lengthy and uncertain processing time for H-1B visa petitions in the US stands in contrast to the measures that China, for example, is currently trying to implement. The country’s newly introduced China Talent (R) Visa program is characterized by the complete absence of application fees and is expected to allow applications submitted by talented foreign workers to be processed within a few working days.

China's legal system under scrutiny after court documents go missing

Missing legal documents, sabotaged security cameras, a Supreme Court judge's video testimony and a television celebrity's plea for justice have raised new concerns about the impartiality of China's legal system.

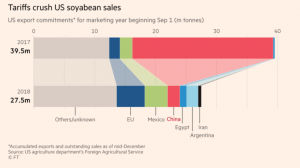

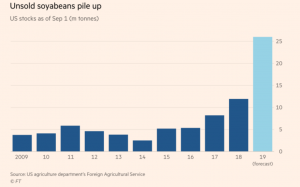

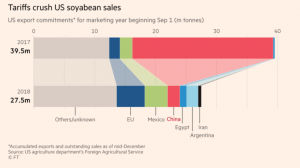

Soya Beans

US farmers are suffering and part of that suffering is due to Trump's war on trade:

https://farmpolicynews.illinois.edu/2019/01/china-purchases-u-s-soybeans-and-u-s-china-trade-talks-conclude/?utm_source=farmdoc+daily+and+Farm+Policy+News+Updates&utm_campaign=d18d705af6-FPN_RSS_EMAIL_CAMPAIGN&utm_medium=email&utm_term=0_2caf2f9764-d18d705af6-175258397

Strongest opponents of GM foods know the least but think they know the most

The most extreme opponents of genetically modified foods know the least about science but believe they know the most, researchers have found.

“This is part and parcel of the psychology of extremism,” said Philip Fernbach, a researcher at the University of Colorado and co-author of the 2017 book The Knowledge Illusion. “To maintain these strong counter-scientific consensus views, you kind of have to have a lack of knowledge.”

The index ranks passports in terms of how many countries holders can access without visas. While interesting, the real gold is in the following report: Henley Passport and Global Mobility Report

There are gems like this:

The increasingly lengthy and uncertain processing time for H-1B visa petitions in the US stands in contrast to the measures that China, for example, is currently trying to implement. The country’s newly introduced China Talent (R) Visa program is characterized by the complete absence of application fees and is expected to allow applications submitted by talented foreign workers to be processed within a few working days.

China's legal system under scrutiny after court documents go missing

Missing legal documents, sabotaged security cameras, a Supreme Court judge's video testimony and a television celebrity's plea for justice have raised new concerns about the impartiality of China's legal system.

Soya Beans

US farmers are suffering and part of that suffering is due to Trump's war on trade:

https://farmpolicynews.illinois.edu/2019/01/china-purchases-u-s-soybeans-and-u-s-china-trade-talks-conclude/?utm_source=farmdoc+daily+and+Farm+Policy+News+Updates&utm_campaign=d18d705af6-FPN_RSS_EMAIL_CAMPAIGN&utm_medium=email&utm_term=0_2caf2f9764-d18d705af6-175258397

Strongest opponents of GM foods know the least but think they know the most

The most extreme opponents of genetically modified foods know the least about science but believe they know the most, researchers have found.

“This is part and parcel of the psychology of extremism,” said Philip Fernbach, a researcher at the University of Colorado and co-author of the 2017 book The Knowledge Illusion. “To maintain these strong counter-scientific consensus views, you kind of have to have a lack of knowledge.”

Subscribe to:

Comments (Atom)