Here is the prelude to this post - a quote from a recent Gartman letter:

ON THE POLITICAL FRONT, we attended a board meeting at one of the universities in whose endowment/investment committees we are Board members and we were really quite astonished at the antipathy of those we spoke to regarding President Trump. Previously, those we had spoken to were staunch supporters of the President, welcoming his attacks upon the massive numbers of regulations that the previous Obama Administration had imposed upon the economy and openly supporting the tax cuts and judges appointed; but the depth of anger over the President’s tweeting and “un-Presidential” demeanor was really quite stunning. However, what truly caught our attention was the anger at the President over his most recent verbal attacks upon the Federal Reserve Bank. To several “That was the last straw.” When the President losses men and women of this sort who had supported him openly before he is in very real trouble. We are simply reporting what we’d heard.

The Gartman Letter LC, November 29, 2018

Impact on the Farm Economy and Why it is not an Opportune Time to Invest in Farm Equipment Manufacturers and Distributors

I follow statistics on farm income closely. Why?

The Farm Equipment Market

The following article provides a comprehensive overview of the farm equipment market from the perspective of equipment dealers. It is well worth reading in its entirety.

A few things to consider when reading the article:

- optimistic forecasts are seldom proved out in reality ... in recent years outcomes have been worse

- the sustained nature of sales of lawn and garden equipment ... so far (it all depends on the economic well-being of non-farm households)

- trends in sales by major equipment manufacturers - an indicator of stocks that one might want to buy when things eventually recover?

- the general gloomy outlook for sales

At present, farmers are suffering. Crop prices are low due to global oversupply - the result of increased capacity in South America and China and efforts on the part of importing counties to reduce their consumption by substituting imports for lower cost alternatives derived via technological innovation and/or direct substitution for lower (often not as satisfactory) food stuffs. The high American dollar has also been a factor.

This suffering is compounded by Trump-imposed tariffs which have had the following impacts:

- The increase in tariffs on steel and aluminum have increased input costs on the part of manufacturers - costs which will be passed on to the customers of farm equipment manufacturers or which will constrain bottom lines if manufacturers decide to absorb some of them. US steel manufacturers took the tariffs as an opportunity to increase their prices, thereby negating Trump's protectionist measure - an unforeseen consequence ... or an obvious consequence which was either unanticipated or ignored by Trump (if indeed, it was even within his capacity to imagine).

- The impact of cost on new equipment sales and innovative technologies cannot be underestimated. In response to a recent survey by AgPulse, and the question, "What’s your biggest barrier to implementing new AgTech on your operation?", 55 percent of farmers indicated that cost is the greatest barrier; 25 percent were concerned about ROI ... all other reasons were far less important:Ag Pulse Survey

- US tariffs have prompted retaliatory measures on the part of countries such as China which have been very selective e.g. increased duties on soy beans have had a major impact on export markets in the Midwest and driven down prices. The contagion has spread to Canada: Canadian farmers are finding it more difficult to find export markets due to competition and high shipping costs.

- The long-term impact of tariffs has yet to be expressed. There is a palpable dislike of Americans in much of the world - an attitude which has worsened since Trump took office. How this will influence patterns of trade and consumption has yet to be determined.

- It has implications for the farming community. The following article provides a good synopsis of the concern over tariffs which prevails in the agricultural community: https://www.farmforum.net/farm_forum/market-analyst-tariffs-trade-and-more-talk/article_6ec6f8cf-f8e6-5bb8-993b-86bb10c78310.html. It makes for some sobering reading and does not bode well for the short term.

- See this take on Trump's trade war tactics by the CEO of Deere - wonder if he is now a Trump supporter? Deere CEO Worried About Lasting Impact of Commodity Tariffs.

As noted above, future projections on the part of the equipment industry are usually optimistic ... and unreliable. The following article from 2016 shows just how far off the mark forecasts can be:

A few highlights:

- This year will likely be the worst year of the commodity price downturn for US row crop farmers as many enter their third year of negative net incomes, according to Kenneth S. Zuckerberg, senior research analyst at Rabobank Food & Agriculture.

- Zuckerberg also believes that along with a stabilization in crop prices, farm incomes will stabilize around long-term break-even levels for five years. This means the situation will not improve as quickly as in other commodity cycles. “This is based on Rabobank’s view that commodity prices will not improve much over the intermediate term,”

Farm Incomes by the Number

This post is already overly long but it is worth looking at the rate of farm failures, the ultimate measure of the state of the farming economy.

And that nagging economic strain of low commodity prices on farmers and ranchers—compounded for some by recent tariffs—is starting to show up not just in bottom-line profitability, but in simple viability. Over the 12 months ending in June 2018, 84 farm operations in Ninth District states had filed for chapter 12 bankruptcy protection—more than twice the level seen in June 2014 (Chart 1).

https://www.minneapolisfed.org/publications/fedgazette/chapter-12-bankruptcies-on-the-rise-in-the-ninth-district

Commentary on Farm Incomes

Statistics tell one aspect of the story. Just as compelling are the narratives of those in the farming business. The narratives are indicative of community mindsets - one of the main drivers in decision-making on the part of those involved in agriculture and other pursuits.

Here is a selection of comments made by bankers in the most recent edition of the AgCredit Survey of the Kansas City Fed

Higher interest rates, along with increasing fuel and repair costs are key concerns for producers. – Southwest Kansas

Much of our area was hit with significant drought, which paired with the currently low commodity prices has reduced capital for most producers. – Northeast Kansas

Devaluation of land, cattle and equipment are causing adjusted analysis of borrowing capacity and cash flow. – Central Kansas

Current grain prices make it very hard for borrowers to cash flow. Trade agreements need to be worked out with other countries to hopefully help prices rebound. – Southwest Kansas

We are on the border line between drought and severe drought. Most farm customers will produce 60 to 80% of normal and will have income deficiencies. – Western Missouri

Deteriorating working capital and overall equity erosion of ag customers is starting to have a significant impact on producers and lenders. – Western Nebraska

A Few Conclusions

- Forecasts by farmers and those involved in the farming economy are usually too optimistic.

- The Trump-initiated trade war has had a double negative impact on the farming economy: increased input costs and reduced commodity prices.

- Farmers are not in a mood or position to willingly purchase new equipment. They are doing everything they can do to stay above water.

- I figure that it is not an opportune time to invest in the agricultural sector.

However

- Things change.

- Equipment manufacturers and dealers have learned to manage throughout the agricultural cycle. If anything, they have reduced overheads and introduced efficiencies which should benefit them when the economy recovers.

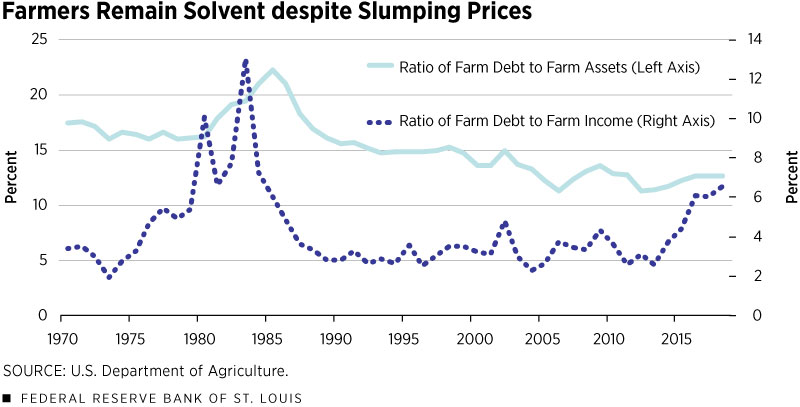

- In comparison with recent declines in commodity prices, today's farmers have kept a reasonable handle on managing debt. When commodity prices improve, they will be able to allocate more funds for new purchases than in years previous when debt loads were much higher.

- I have assembled a "buy list" of companies in anticipation of the turnaround. A few things the companies share in common:

- low debt

- profitability

- great management which has been at the helm during tough times in years previous

- excellent, competitive products and services and a scale that should enable internal efficiencies

- a good reputation in the farming community

- the potential to capture more market share