- the company's presentation is compelling

- its business model has potential

- management has rewarded itself at the expense of share owners

- its primary revenue streams are not ironclad

- I suspect that its stock price has risen on a tide of optimism in the biotech/pharma sector

My voyage started with a survey of pharmaceutical companies. The search broadened as a result of insights gained from two references which are cited below under Overview.

Some key points emerged during the initial phase of my reading:

- the sense that information management (Health Care Big Data) will be one of the dominant drivers shaping the future of health care delivery e.g. the development of drugs, delivery of health care, evaluation and pricing of services

- the forces of transformation will eventually force the conservative culture of the medical community and pharma industry to change

- dominant players (payers, information managers etc.) have shown an ability to adapt; they appear to have an advantage as a result of their size and access to data; and, they are adopting a variety of different strategies which provide informed investors with considerable scope to make judgements on the relative effectiveness of company strategies

- markets for goods and services differ considerably across the world depending on patterns of disease, population genetics, ability to pay, population structure, culture, and so on

- there is a role for specialized niche players

Here are a few useful references which I would urge everyone to read:

Pharma and Biotech Industry Outlook

I came across this while searching on Google images. I clicked on a graph in images and found a very interesting web site named Slide Share. Founded in 2006 with the goal of making knowledge sharing easy, Slideshare joined the LinkedIn family in 2012 and has since grown into a top destination for professional content. With over 18 million uploads in 40 content categories, it is today one of the top 100 most-visited websites in the world.

I have subscribed to the site - some great reading.

The above-noted reference provides an overview of the industry: the players, trends, implications for the future.

From Vision to Decision - Pharma 2020

A comprehensive overview including tailwinds and headwinds - check out the meaning of "HONDAs" - individuals who account for 70 percent of healthcare costs. Don't be one of them.

The document provides a useful synopsis of the decision-making processes of pharma companies - something which is vital if you are planning to analyze the prospects of a potential investment. I was especially interested in the range of strategies for drug development. Fascinating.

The above-noted papers are two in a series of five: http://www.pwc.com/gx/en/industries/pharmaceuticals-life-sciences/pharma-2020/business-models.html

Can Big Data Fix Health Care?

This is a well written article, replete with a variety of embedded references of high quality. It makes a compelling case for the likelihood that big data will be the vehicle to transform our health care systems. For one thing, the current models will be unaffordable in much of the western world due to an aging demographic and competing demands for government funding. Doctors and other conservative elements will be forced to change when confronted with the realities of evidence-based policies on the part of those who fund the medical system. There will be considerable friction in the competition for control, but it need not be a win/lose situation for participants. This reading has fundamentally changed the way I look at the health care system.

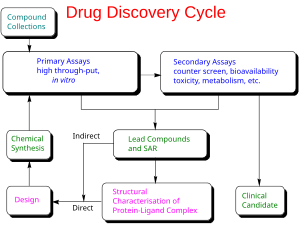

The Drug Discovery and Development Cycle

There are two basic aspects to bringing a new drug to the market: discovery and, development.

A. Discovery

A description of the discovery cycle is presented here:

https://en.wikipedia.org/wiki/Drug_development

The advance of genomics and greatly enhanced capabilities of managing "big data" has revolutionized the cycle - increased its speed, increased the potential to "target" drugs more effectively in consideration of genetic variation in recipient populations, and in refining the composition of candidate drugs.

B. Development

This part of the cycle is lengthy and entails tremendous expenditures and risks on the part of drug companies - in excess of $1 billion per drug if everything goes "right" and there are no bumps along the road. There are many potential points of failure on the way to the market place, including: toxicity, failure to deliver anticipated results, unwillingness of government to pay, and a reduction in anticipated revenues through government demands for cost effectiveness studies, etc. Even after drugs have reached the market, companies always have to consider the prospect of competition from cheaper, more effective remedies.

In 2014, an article was published in Nature analyzing the clinical development success rates for investigational drugs. It's no surprise that the success rates are still somewhat dismal with 1 in 10 drugs that enter clinical phases pushing through to FDA approval. The article breaks down the success rate in each phase for differing classes of drugs as well as various therapeutic indications. NMEs were found to have the lowest success rates in every phase of development (7.5%) whereas biologics had nearly two times the success rate (14.6%).

http://www.mdbiosciences.com/blog/drug-discovery-success-rates-the-role-of-preclinical-study-design

I will not pursue this in more detail in this posting. However, there are some useful waypoints for investors:

- the days of "blockbuster" drugs appear to be waning - some tremendous profits are being made with drugs such as Crestor but many cash cow blockbuster drugs are coming off patent, meaning that cheaper generic drugs will erode profits of the original developers

- large pharma companies are adopting a variety of different corporate strategies for discovery and development (see first two references for more detail) without any guarantee that they will be successful as in the days of olde

- there is a trend for custom drugs targeted to specific (sometimes rare) diseases and the genetic make-up of individuals and populations but with lower returns to a company's bottom line

- the role of information is increasing in importance both in formulating compounds and in testing them more effectively

- government is more amenable to changing the approval process to both shorten and make approvals more effective, including monitoring drugs once they have entered the market

- collaboration between countries in the approval and monitoring process appears to be increasing

- some drugs claim to double life expectancies but in the case of terminal diseases how can the public be expected to pay tremendous sums when lives are extended only by 18 months or so at a cost in excess of $50K per individual (not including associated medical costs)? I suspect that medical funding could be allocated for more robust returns. It will be very interesting to follow Canada's policy for assisted death as it appears to be signalling a sea change in public attitude.

In light of this, I decided to focus on smaller entities specializing in drug discovery where investments are comparably smaller than in drug development. In essence, beasts of this nature are more "knowable".

When investigating companies in the discovery niche, I looked for beasts with the following characteristics:

- excellent management with a long history of working in the area of discovery

- technical excellence and services/products with a competitive advantage

- the ability to partner effectively with larger entities

- a business model which reduces risk by concentrating on the company's expertise

- the potential for significant gains as a result of contractual arrangements with clients

Ligand Pharmaceuticals (LGND)

Why?

- Its business is focussed and comprehensible.

- Its business model appears to be a good fit with the modern pharma business.

- It has demonstrated an ability to change its business model to exploit opportunities

- A few larger participants in the systems require a "jump of faith" for investors as the businesses are complex, prone to major disruption as a result of government intervention, potential legal difficulties, and competition.

However, as I started to investigate the company in more detail, my research started to focus on a few aspects related to the nature of the pharmaceutical industry (competition, government regulation and approval process, future demand) and the strategic position of Ligand Pharmaceuticals. Once this was done, I concluded my research with an investigation of a few areas specific to LGND: management, balance sheet, income streams etc.

Here is a very informative 127 page investor presentation.

http://content.equisolve.net/_d41d8cd98f00b204e9800998ecf8427e/ligand/db/184/592/pdf/Analyst+Day+Nov_18_2015v+Full+FINAL.pdf

Read it diligently and you will develop a good understanding of the company's strategic positioning, its business model and its operations.

Ligand is a turnaround story: activist investor seeks to extract value - turnaround expert stays around ...

life-after-loeb-ligand-pharmaceuticals-prospers-in-stripped-down-mode/

john-higgins-of-ligand-pharmaceuticals-on-restructuring-a-business-and-streamlining-operations-how-to-refocus-your-business-by-setting-priorities/?all=1

I was almost ready to purchase shares, but as always, I dream about a potential investment for a few nights (creative dreaming). I wondered about the company's profitability over the long term. Sometimes, you can cut too much by way of monetizing assets. I've learned that many of most profitable advances come about as a result of chance conversations and curiosity. Some companies are more able than others to create this environment. It is not something that can be measured on a balance sheet. I don't know if LGND has the critical mass of people to do this, especially when main office is concerned primarily with managing relationships. Also, it's a real management challenge to cultivate this climate when participants in an enterprise are separated by distance and organizational units. This is the "softer side" of evaluation. I've seen several companies which have this "magic jelly" and I'm not convinced that I see it with Ligand. I may be wrong and will leave it to readers to arrive at their own conclusions.

In the light of day, I started looking for potential shoals:

- LGND's stock compensation is very high. In fact, in the 3rd quarter of 2015, stock-based compensation compared to revenue was the third highest in S&P 1500 listed companies - 25 percent of quarterly revenue. http://www.marketwatch.com/story/twitter-shows-how-companies-enrich-executives-at-your-expense-2015-02-06

- A short seller, Lemelson Capital, has taken a decidedly negative attitude to LGND. Over the next week or two, I will take a critical look at its argument. In its "rock flipping" it uncovered some minor irritants; however, a few of them warrant further investigation. http://www.amvona.com/featured/finding-alpha/item/36339-ligand-pharmaceuticals-severe-competitive-threat-to-key-royalty-program-and-“going-concern”-risk-drive-100-percent-downside#comments

Sometimes, when entering a particularly challenging anchorage which is new to me, I will drop the hook on the approach and then take to the dinghy to explore the situation in more depth (pardon the pun). Only when I am satisfied that there is a good margin for safety will I make a decision to proceed. I follow much the same procedure for investing.

No comments:

Post a Comment