A recent series of articles would suggest that this is the case in the short term.

In order to "take the pulse" of the equipment sector, I consult several trade publications on a regular basis - among them:

Farm Equipment

The Progressive Farmer

Agrinews

Farm Journal

Capital Press

Regional newspapers are also a useful source. For the "long view" I turn to state and national governments, especially when investigating themes for potential investments. Some universities with major agricultural programs yield precious insights as well.

Combined, these source provide a variety of insights:

- a sense of the prevailing mindsets of the agricultural community

- "hard" information on topics such as yields, sales

- developing trends

- leads on innovative products/services (Clean Seed Capital come on down)

You hardly ever get this comprehensive perspective in reports issued by investment analysts: they simply do not have the time. When I look back at the history of my most successful investments in agriculture, virtually all of them originated on the basis of leads generated by extensive reading of the above-noted sources. Not one of the leads was generated by reading the financial press or reports by financial analysts. (They are generally quite boring - same old same old metrics and approach and lacking the freshness and enthusiasm of the best of the movers within the agricultural community.)

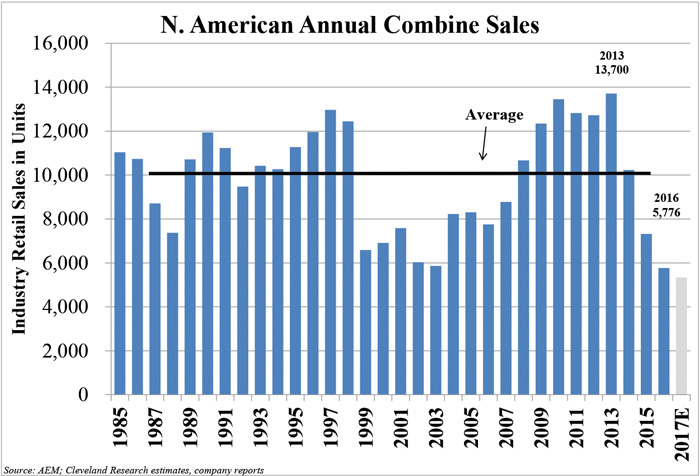

I have been interested in sales of agricultural equipment, the result of deciding to focus on equipment manufacturers and dealers a few years ago. There is a central theme which dominates thinking in the sector; namely, annual sales. It can be reduced to the graph which appears below which is presented in:

The Hits Keep on Coming

There are several possible interpretations of the graph:

- We may be in a multi-year period of relatively low sales if one thinks that there will be a repeat of the years 1999 - 2006. If one considers that farm input costs are still rising and that commodity prices are likely to remain low, the outlook for future sales may not be all that attractive. In this environment, farmers seek to minimize operational costs. They are keeping old equipment longer and not buying new equipment as much. (Parts/service receipts from dealers would suggest that this is the case.) Also, used equipment prices would appear to be attractive as dealers seek to clear their inventories of used equipment.

- It would appear that sales of new equipment are near an all-time low, at least relative to 1985. On this basis alone, some may contend that things cannot stay at this level forever. Others may opine that the "replacement cycle" for equipment may cut in at some point, especially on the part of larger operators where there is an imperative for reliability.

I am going to take a "wait and see" attitude. Why? It's all centred on if/when:

- There yet remains a strong potential for a significant correction in the stock market. If/when this occurs, the exchange listed stocks of equipment manufacturers and dealers will inevitably fall in the general downdraft. If/when this happens, investors will be presented with an excellent buying opportunity.

- Commodity prices are likely to increase at some point due to a variety of factors such as differences in yearly yields in major producing countries/regions. If/when this occurs, farmers will have funds for new purchases. This said, there are headwinds for North American farmers: the uncertainty of NAFTA, the new normal of major climate/weather events, increased competition from producers/marketers in South America, etc.

- At some point, the equipment replacement cycle will turn. It will simply be uneconomic to repair old equipment and retain an acceptable level of reliability. This is not a question of if but when.

On balance:

- I think that the replacement cycle is starting to kick in. But alone, it will not propel significant sales. There are still sufficient stocks of low hour equipment to dampen sales in the short term, especially given that farmers appear to be quite conservative in their outlook (this on the experience of being over-extended a decade ago). For this reason, I will defer on investing for the time being.

- My trigger point for buying will be a downturn in the general market. Farm equipment manufactures and dealers know how to manage their way through lean times, and the best of them will position themselves for an eventual recovery. A market downturn may represent an excellent entry point and an opportunity to profit in the inevitable recovery in the sector.

I have only one position in the agricultural sector: Clean Seed Capital.

Why?

- It has great bones. See previous posts.

- It meets a real need in a way that confers real benefits for its customers.

- It's characteristics are such that it can survive the low point in the agricultural cycle.

- Most important: it has the potential (in my view) to profit mightily once the agricultural equipment cycle turns. This could take place in a variety of scenarios: increased revenue from sales, a take-over by one of the major equipment manufacturers. (See the recent additions to the Board of Directors as the company may be covering its bets on this possibility. http://cleanseedcapital.com/gary-anderson-joins-board-directors-acquires-5-interest-clean-seed-capital-group-ltd-tsx-v-csx/

- I am prepared for the inevitable gyration in the price of CSX, recognizing that it is a nascent enterprise. As such, I am not prepared to attempt "to time the market" this time.